Extend financial accountability & build spend culture with Payhawk Budgets

For finance professionals, access to granular budget data means two things: Better budget management & budget owner accountability. Both will help you streamline financial reporting and analysis to drive growth — and free yourself from your business budget sheet to embrace better budget management.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

When managing budgets, is there anything more tedious than when month-end rolls around and predicted spending doesn’t match actual spending? Not only is this draining on the FP&A teams’ time, it doesn’t make business sense.

If you consistently find that your spending is way over prediction or that your teams are spending their budget on things that don’t align with your overarching strategic goals, you need a better way to forecast accurately.

That’s exactly why we’ve released a new budget tracking feature: to enhance financial accountability, accuracy, and transparency and foster a culture of responsible spending.

Four budget tracking challenges

Your finance team needs accurate budget data for smart financial planning — but there are often a few roadblocks in the way, including…

1. Lack of real-time data

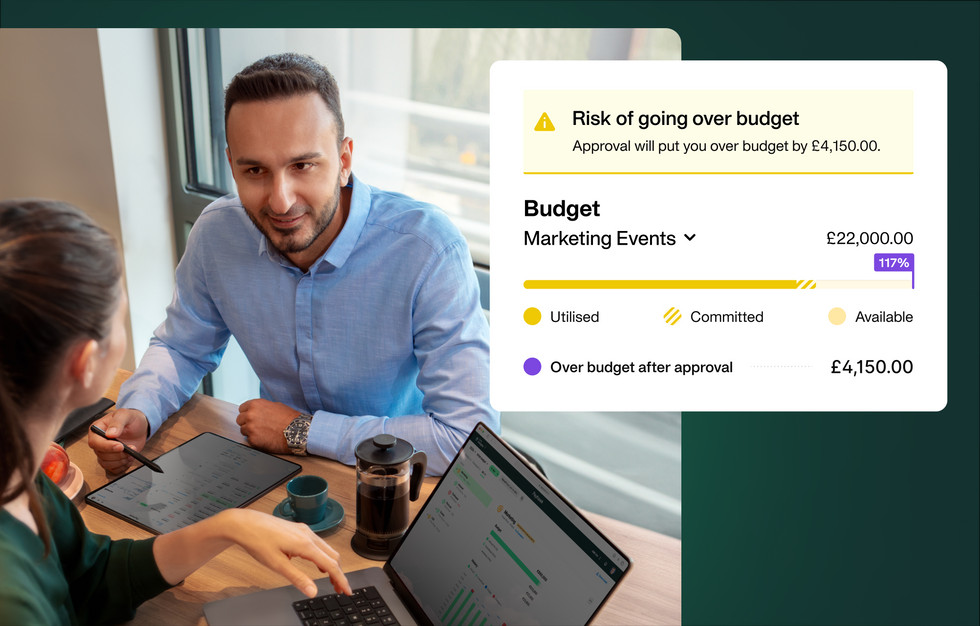

Accurate budget utilisation data needs to be accessible to both finance teams and budget owners, like managers from marketing or IT. Without this information, budget holders can easily make ill-informed spending decisions, leading to major strategic misalignment and overspending.

Budget holders need real-time budget data at their fingertips to make impactful decisions.

2. Budget owners making poor decisions

Some things are outside the finance teams' control (including budget owners). And if budget owners make spend decisions without enough care, the gap between what was planned and what was actually spent will only come to light at the end of the month.

The above means finance team members inevitably need to make last-minute adjustments to their budget plans instead of focusing on other priorities, like helping the CFO strategically plan for growth.

3. Lack of accountability

If spending isn’t in line with strategic goals, you’ve got a problem — the organisation can’t progress toward its main objectives. Given that financial planning and analysis teams have no authority over budget owners, the lack of accountability can be significant. Spending here, there and everywhere means no one can plan, and the organisation doesn’t move forward.

4. Inefficient communication

You need effective communication between FP&A teams and budget owners. If there’s currently a lot of back and forth between the two about budget utilisation, there is plenty of opportunity for misunderstandings and miscommunications about budget status and requirements. Everyone needs to be on the same page, which means aligning priorities and objectives and appreciating the broader financial strategy.

For strategic planning to be the main focus for all departments, everyone must work together towards a common goal. At Payhawk, our new feature empowers organisations with better budget visibility by bridging the gap between challenges and solutions.

The importance of solving these problems

Getting a handle on budget tracking and planning can make a big difference in driving growth, empowering you and your team to make better decisions, and improving future financial performance.

With Payhawk Budgets, your finance team can:

- Nurture responsible spending thanks to real-time budget utilisation data

- Foster a culture of informed decision-making and strategic resource allocation that is in line with financial planning

- Make month-end easier and more predictable and avoid financial discrepancies thanks to responsible spending

- Create time for your team to focus on strategic initiatives by streamlining budget management

- Improve overall financial health by ensuring spend is aligned with the organisation’s priorities

- Adapt quickly to changing business conditions with a flexible budget management tool that allows rapid adjustments and re-allocations

Meanwhile, your FP&A team can:

- Enable the organisation to make informed spend decisions that are always in line with the company strategy

- Facilitate seamless collaboration with budget owners and focus on strategic initiatives rather than admin tasks and back-and-forth

- Enhance data accuracy in strategic planning with access to real-time budget utilisation data

And budget holders can:

- Empower smart decision-making with real-time data on how your budget is being utilised

- Leverage real-time insights to plan your budget allocations with greater confidence

- Remove administrative burden and enjoy a more efficient budget management process that eliminates manual work and inefficient back-and-forth

- Keep your spending aligned with company goals

How Payhawk improves budget tracking and visibility

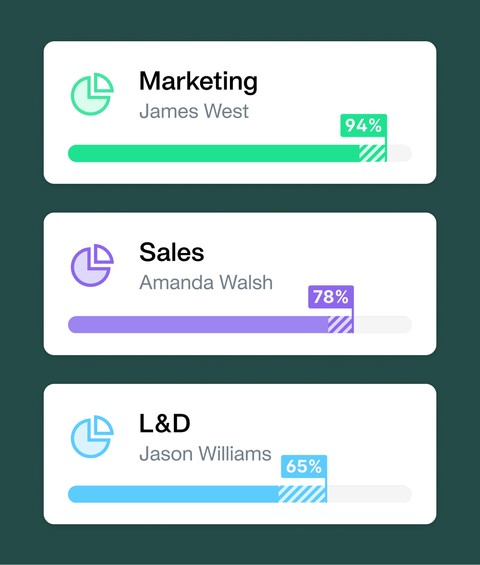

At Payhawk, our built-in Budgets module lives within the Payhawk platform, which means all data is accessible to anyone who needs to see it.

This approach means you all access the same information, making budget planning easier and more streamlined for everyone involved with allocating, managing, and spending company funds.

Plus, you can monitor your budgets in real time in the same system where you manage all your business spending, keeping everything streamlined and connected.

Here’s are a few of the most important things you can do:

Create budget templates

You can customise forecast templates within the platform, download them in Excel, and upload them to track and plan budgets. Users can also upload unlimited new forecasts for enhanced planning.

Our budget template comes pre-loaded with dedicated columns for fields including budget owner and currency, columns for the budgets per month for 12 months after the fiscal year start that was selected, and columns for the actuals and updated forecast for the same 12-month period.

Plus, you can customise your forecast template with as many dimensions as needed to fit your budget structure, for example:

- Categories

- Teams (the custom name of teams will be displayed here “e.g. Departments”)

- Entities (if on a group - this is selected and cannot be unchosen)

- Suppliers

- Custom fields (project, Location, etc.)

- Employees

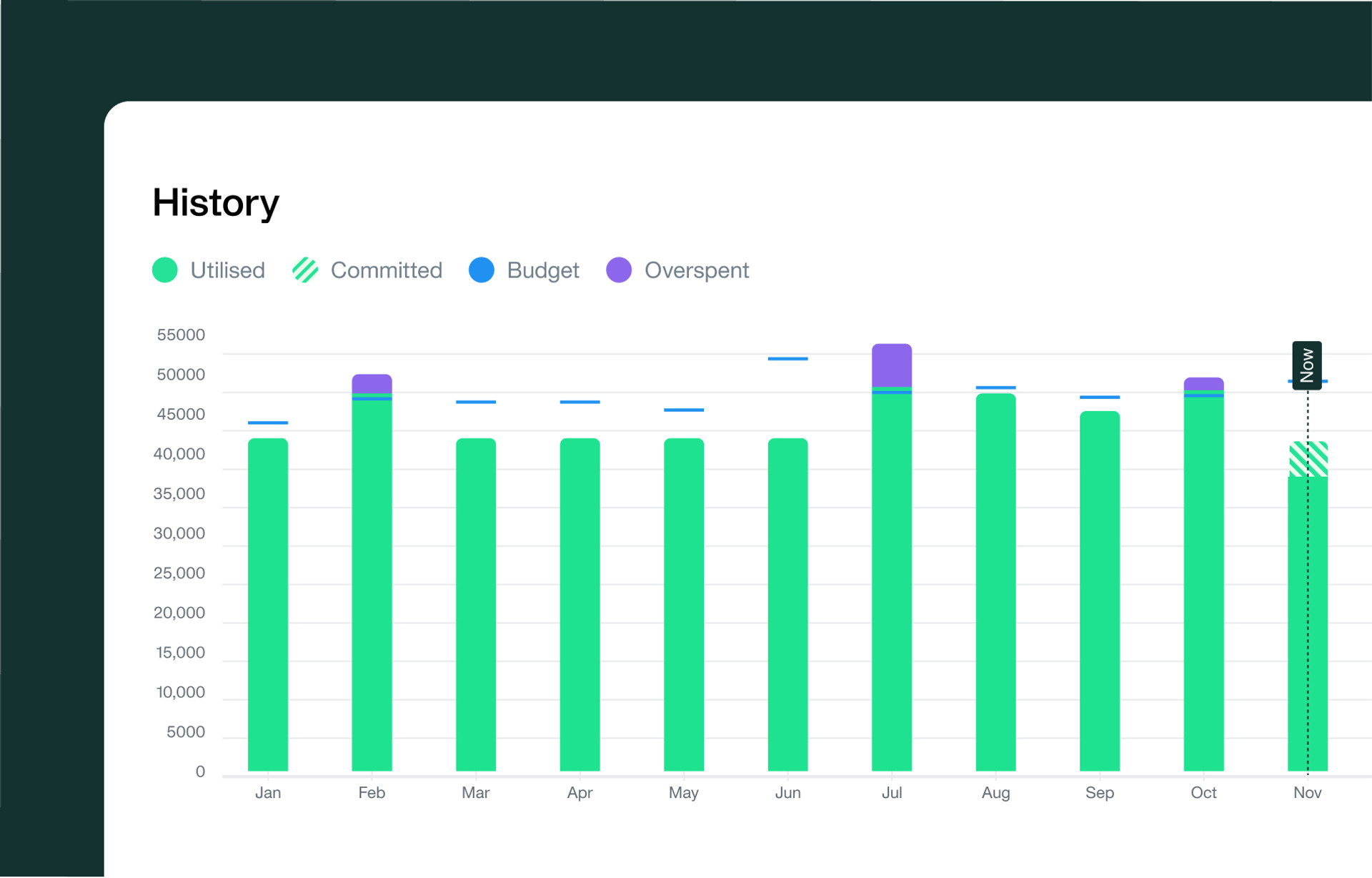

View historical budget data

Our platform displays historical budget data using visual graphs, making it easy to understand future commitments and make changes to cut costs proactively.

Analysing past and current spending helps you identify why costs have risen, allowing for proactive cost-cutting measures.

Filter budget data in granular detail

Budget owners will be able to filter the data per:

- Employee

- Supplier

- Category

- Custom field (this literally can have endless possibilities)

- Team

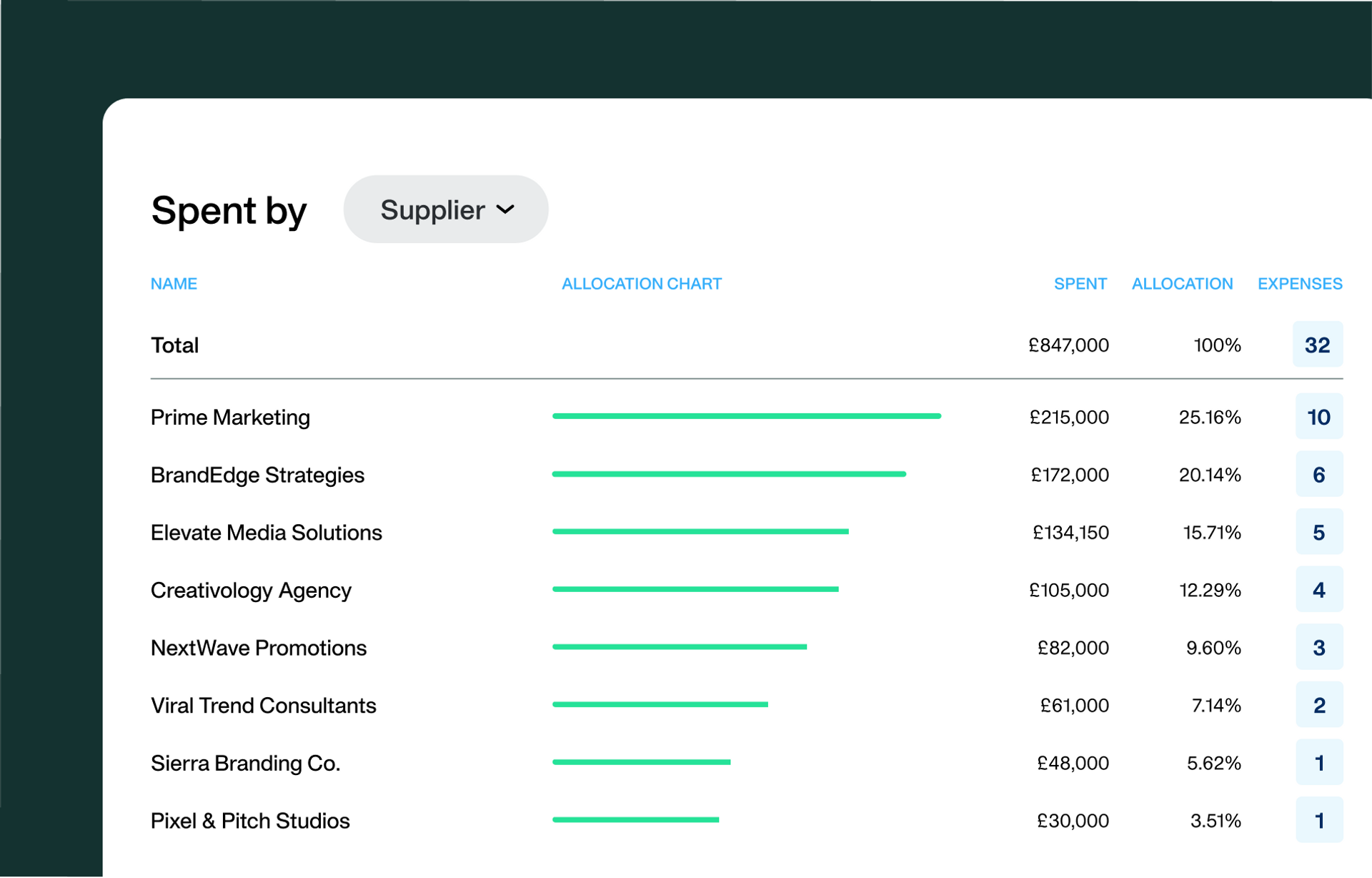

The example below shows you how the supplier filter will look when applied. You can see how much has been spent with each supplier, how much of your budget is allocated to each supplier as a percentage, and how many expenses are outstanding.

Being able to quickly toggle between who has spent what gives you insight into making changes to budget allocation. Perhaps you think you’re spending too much with a given supplier or realise a certain employee has been spending more than others.

By leveraging the data visualisation tools and granular filtering options, you can empower both your finance teams and budget owners to make data-driven decisions that align with strategic objectives and financial goals.

Your next steps

Struggling with budget tracking and planning? It’s time to make a change.

At Payhawk, we understand that aligning spending with your company's strategy is critical for growth.

Our platform (including our new Budgets capabilities) offers multiple ways to enhance financial accountability and visibility, empowering you to make informed, strategic decisions.

Ready to streamline your budget management and make your team's job easier? Request a personalised demo now to see how we can help you take control of budgets, encourage accountability, and better manage spend.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Smart money just got smarter: How AI is helping move money in 2026