Mileage reimbursements with Payhawk

At Payhawk, we know how tedious it is to have several systems just for company expense management. That's why we're launching a new feature that gathers all the information related to mileage reimbursements. So your team members who use their own vehicle for business-related matters can be reimbursed fast and accurately with just a few clicks.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Mileage claims can be tricky for businesses to reconcile. Seeing as employees don't get receipts for which miles were made for work, it's hard to calculate the exact cost of the work expense. That's why we're thrilled to announce our newest feature: mileage. Our product and engineering teams have wrecked hard to make this feature as seamless as possible, and here's how it works.

What is mileage reimbursement?

When employees use their own personal vehicles to do business-related travel, businesses should pay the employee for their vehicle usage. In general, mileage reimbursement does not cover the commute to work, only travel done during working hours, such as visiting clients, picking up office supplies, or going to meetings.

The fixed rate for each mile/km is set by the national tax agency or the company. It generally considers the cost of insurance, registration, gasoline, oil, maintenance, parking, and tolls.

Why is it important to track?

Mileage is important to track as a business expense because the company needs to reimburse the employee, and it can be tax-deductible. The significance of the above means that employees who use their own vehicle for business purposes should have an easy way to report the distance travelled for work purposes, as well as any other necessary info relevant to calculating the reimbursement.

Simplify work travel with the Payhawk's mileage tracking

How does Payhawk's mileage feature work?

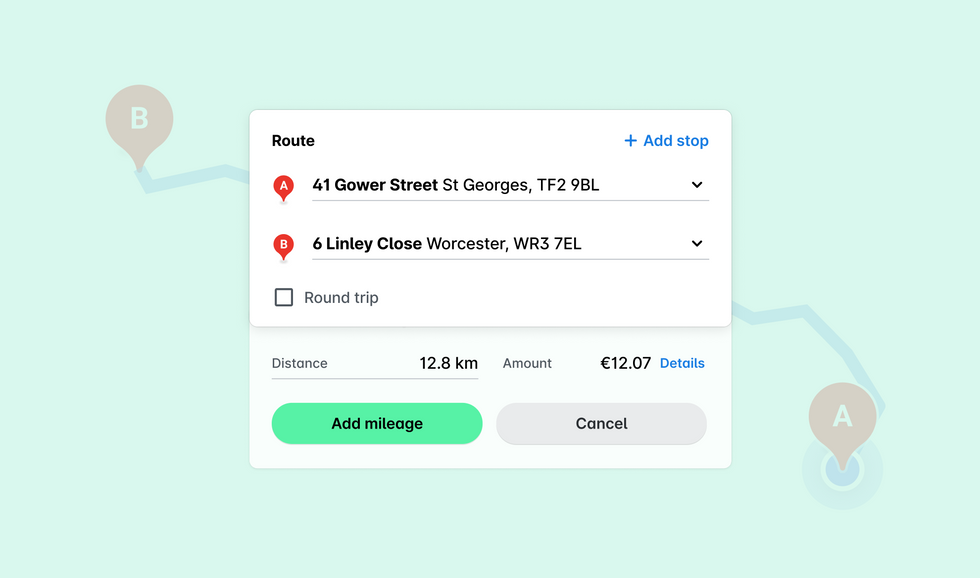

- Employees simply add details of their journey (start location, end location) to the Payhawk app, and the expense for the correct amount is calculated automatically

- Journey distance is automatically calculated based on their journey's start and end point using Google Maps. The employee can manually adjust for journeys that are significantly different in length from the Google Maps suggestion. They can also add stops for more complex routes

- Administrators can configure the mileage rate and assign a workflow aligned to the company’s spend policy. Once everything is verified, team leads can reimburse with a single click.

What are the benefits?

Without a mileage tracking and reimbursement feature, employees will generally have to do several manual and time-consuming processes, such as checking the odometer before/after the journey. Employees may even end up guesstimating the distance, often inaccurately, resulting in wasted time for the employees who will ultimately get reimbursed the incorrect amount.

Finance managers (or administrators) need a way to verify on one hand if the trip was for work purposes and, on the other hand, the distance reported. This verification can be tough to do reliably without significant manual work. Hence this takes considerable time and still results in errors. Once approved, the finance manager needs a way to reimburse the funds to employees.

Both employees and finance managers want a way to manage this type of expense alongside all other costs in order to save time and streamline processes.

Today, many companies use multiple tools to track and pay employee expenses. If this is the case at your business, we encourage you to book a demo with us today to learn how we can help you streamline your business finances.

An integral part of Payhawk’s journey from the very beginning, Raquel has seamlessly transitioned across key roles—starting in sales, building the customer success team from the ground up, and later moving into content and product marketing. Today, she thrives as a Senior Product Marketing Manager and also leads the company’s ESG efforts. Outside of work, Raquel is passionate about the outdoors and enjoys swimming, hiking, and baking for her two children.

Related Articles

Beyond chaos: Structured data access controls for secure expense management