Accounts payable invoice reconciliation strategies: Five steps to success

Invoice reconciliation is something of an unsung hero when it comes to corporate spend management. It’s essential but rarely gets the recognition it deserves. Getting it right can save your business time and money and help promote good supplier relationships, but where should you start?

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Creating an effective accounts payable invoice reconciliation strategy will make your finance processes more accurate, improve your project cost breakdowns, and ensure that you can complete any necessary spend reports on time.

And without a robust accounts payable invoice reconciliation strategy? You and your finance team will likely spend hours chasing down receipts, correcting errors, and putting things back in the right place.

In this post, we delve into some popular invoice reconciliation strategies and initiatives, uncover additional strategies for speeding up reconciliation, and dig into the different ways you can create a single point of accountability to encourage alignment and get everyone on the same page.

We also explore the following key elements of an effective reconciliation strategy:

- Communicating the vision to core stakeholders

- Understanding accounting accountability

- Saving time and effort with accounts payable automation

- Improving spend control with real-time data

- Add value to the entire process through human interaction

Transform the way you spend with integrated procure-to-pay features

Step 1: Communicating the vision to core stakeholders

Strategic alignment is essential if you're directing a digital transformation project, and that starts with effective stakeholder communication and buy-in.

If you plan to implement new invoice reconciliation strategies or software, you must ensure all your key stakeholders understand why and how. Make sure that, as salespeople say, you "sell the sizzle and not the steak," meaning you cover the inefficiencies of the old strategy or tools and explain how the new one will help.

Good communication is about taking people with you rather than just broadcasting information. And it's even better to directly refer to specific examples or feedback on your old processes.

You'll find that any project to revolutionize your invoice reconciliation will be much more successful if everyone is aligned around a common goal and the whole team understands the eventual destination.

Step 2: Understanding accounting accountability

A common strategic mistake when automating accounts payable is to focus on the functional aspects of processing without assessing who needs to be accountable.

For example, it’s all well and good to process thousands of invoices a second using an automated system, but what do you do when those invoices add up to a massive hole in the budget?

A good transformation project will involve understanding not only the functionality behind automated processing but also the lines of reporting, building up a map of who is responsible for what and how each invoice affects budgets within the wider business.

Once you know who is accountable for spending at each budget level, you can start thinking about automating controls.

At Payhawk, our in-built approval workflows let you build and assign approvals right into the spend management solution. You can customize this to add one, two, or multiple approval levels to budget owners and business leaders based on factors like the amount. And you can set auto-approvals based on specific amounts and more.

Plus, while the budget owners can make decisions regarding spend approvals, budgets, and so on, your finance or accounting team can act as the main point of control when it comes to implementing, tracking, and suggesting strategic optimizations.

“We chose Payhawk over Spendesk because we preferred the solution's flexibility. We can set up the correct workflows and choose which parts to delegate to employees vs. the finance team,” explains Carolina Einarsson, Finance Director at Essentia Analytics. “Payhawk has clearly built the platform for finance leaders, and their team has been supportive from the get-go."

Step 3: Saving time and effort with accounts payable automation

Now that you know who’s responsible, it’s time to ensure they can do their jobs as efficiently as possible to help drive the business forward. When you look at accounts payable processes, you’ll find that a lot of the work involves repetitive actions that appear repeatedly every day, week or month.

You also find that the best accounts payable departments have clearly defined rules, processes, and methods, which makes them perfect for automation.

The good news is that you can use accounts payable software to automate most of these things.

For example, you may have a supplier that sends you the same invoice, formatted in the same way daily. Your financial controller then takes the invoice and processes it using the same method and applying the same rules every time.

The above is exactly the sort of task that is perfect for automation because you have already done the really difficult bit, which is defining all of the rules and methods.

At Payhawk, our automation helps finance teams like yours manage invoice reconciliation in multiple time-saving ways, including:

- OCR / AI camera

- Document chasing

- Subscriptions management

- Supplier management

- Categorisation, coding, and custom fields

Automating the simple (or should we say "routine") tasks leaves your people more time to deal with the non-standard things that turn up every day.

"Since we've implemented Payhawk, the benefits have been enormous," says Nick Millard, VP of Finance at GDS Group. "Before Payhawk, it used to be one person's full-time job to chase receipt and invoice information, code up credit card statements to the P&L and manage the costs."

"Payhawk lets us be much more forward-facing. The person who used to chase missing info now has a completely different role," continues Nick. "They can be proactive, track costs, and get visibility of expenses as they happen. Rather than being reactive and always working behind. And that has freed us up to look into future spend rather than always reporting on historic spend."

Step 4: Improving spend control with real-time spend data

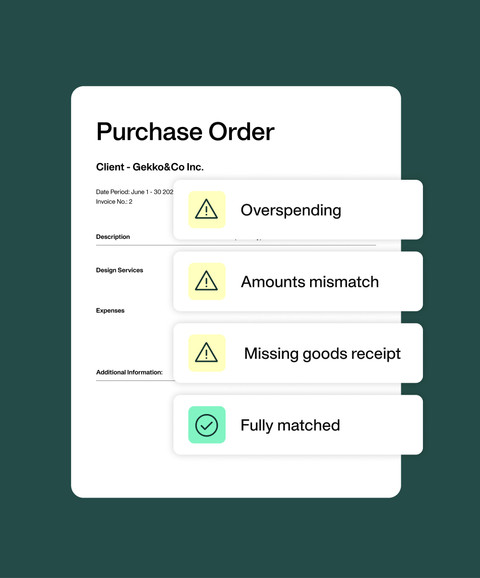

Here's the step where you can incorporate spend controls and automated processing to make sure you're getting the biggest bang for your buck. You can save massive amounts of time and resources on invoice reconciliation and pour that time back into revenue-generating work. And you can save money by pinpointing overspending or cost savings opportunities in your spend data.

Extending the benefits of real-time data beyond invoices, card linking and real-time card feeds revolutionize how card-based transactions are managed. By integrating your existing credit cards with the company's expense management software, every transaction is instantly captured and linked directly to invoice management. This not only streamlines the process of capturing spend data but also ensures that card transactions are automatically reconciled with corresponding invoices.

Move your spend management to the next level

Manage your expenses in real-time with a solution that works with your existing credit cards.

With the right software, real-time invoice reconciliation means real-time spend visibility. And the chance to carve out company spend in a way that will help grow the business and keep teams on budget.

Let's take Payhawk customer State of Play, for example. Andrew Jacobi, VP of US Finance at international entertainment company State of Play Hospitality, explains how digging into spend data from invoices and card spend can help keep their multi-entity business on track.

"We really rely on the customizable class settings within Payhawk to distinguish between venues so we can analyze performance," Andrew says. "We create the custom fields that our cardholders use to categorize their spend. So, whether it's categorizing between venues or categorizing it into the right general ledger code, it's extremely helpful in terms of how we allocate spend."

"For example, we can see what we spent on DJs over the period because of the invoices our operators submitted, and we categorized those invoices to the proper class and GL code, which is venue for us," Andrew continues. "By looking at the spending, we can say, 'We planned $5,000 for this period, but we spent $7,000. So, what happened?' Were we overcharged? Did we increase the frequency of DJs? And if so, should we adjust the budget for the next period?"

Beyond invoices, card controls are vital to any good spend management solution. Take a look at the biggest benefits of ours in the short card controls video, including:

Step 5: Adding value through human interaction

We’ve covered a lot about automation here, and you could be forgiven for thinking that an accounts payable department of the future won’t need people at all. But nothing could be further from the truth.

Automation speeds up the reconciliation and control, leaving more time for your people to add real value by fixing errors and ensuring accounts and rules are set up correctly in the first place.

The work that any busy accounts payable department processes typically conforms to the Pareto rules. In other words, 80% of the work (the routine things) will take 20% of the time, and 20% (strategic initiatives, saving optimization, etc) will take 80% of the time.

Where humans come into their own is on the 20% of work that is difficult to pigeonhole, is new and needs rules set up, or just won’t fit into established processes.

Freeing up your people's time also gives them time to work on real-time reporting of budget accountability, meaning that the company gets a much better service and managers know exactly where they are.

Automating accounts payable is a game changer

Any project to transform an accounts payable department will take a fair bit of effort and require quite some planning.

However, the methodical nature of the work and the defined rules that are in place make it the ideal place to put in automated methods to improve outcomes for the company, its people, and suppliers alike.

Being clear about what you're doing and communicating the vision is the first step towards an automated future and true strategic alignment.

It's also important to have a clear sight of accountability in the process so that you can ensure that any problems are quickly dealt with on the department's side and that managers who are in charge of budgets are identified.

And finally, make sure that you're using humans for the things they are good at, such as problem-solving, strategic planning, and enablement.

Automating your accounts payable process can make a massive difference to the speed of reporting, reduction of errors, and the happiness of your suppliers, so it really is a game changer.

Want to supercharge the invoice reconciliation process at your business? Book a demo to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

From request to payment: Transform your buying process with Payhawk’s AI Procurement Agent