Taking stock and looking ahead: Budgeting for the rest of 2024

Halfway through the year, it's time to reflect on the budget and planning process, investigate whether you should consider your approach and purchases, and make decisions based on your current budget status — over or under budget. Here's a guide to taking stock and planning ahead.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

As we land just over the halfway mark of 2024, it's the perfect time for CFOs and finance managers to reflect on the year so far and plan for the months ahead. Whether you've stayed on a budget or faced unexpected challenges, this mid-year review is crucial for ensuring a strong finish to the year. So, let's dive into how you can reassess your budget, identify necessary adjustments, and make informed decisions for the remainder of 2024.

Uncover top CFO insights on driving growth without compromise

Evaluate the first half of 2024

You’ve made it to July — congratulations! Now, let’s look back at the past six months. What worked well? What didn’t? Examine your financial performance to spot trends and patterns. Why did certain strategies succeed or fail? And consider what you can tweak to boost performance for the rest of the year.

- Review strategic plans: Are your current strategies still relevant? Consider any market shifts or new trends

- Assess your budgeting process: Do your budgets and associated spend controls align with your strategic goals? Do they need adjusting?

- Check compliance targets: Are there any upcoming regulatory changes that could impact your business?

At Payhawk, our solution (and our seamless integrations) gives you complete visibility over spend. Andrew Jacobi, VP of US Finance at State of Play Hospitality, explains how real-time spend visibility in our solution helps them make smarter decisions about costs, allocation, and more:

At the end of the period, we look at two things. First, were we able to forecast our spend properly? For this, we give Payhawk directly to our venue managers so they can report on spend, track spend against budgets, and ensure they're meeting budget across each general ledger category in our ERP (NetSuite). Then, at the end of the period, we look at variance to budget, and Payhawk allows us to spot if there's overspending in specific places up and down our P&L very quickly. For example, if we see that we're spending too much or more than expected on DJs in a particular venue.

Enhance financial reporting quality

With constantly shifting markets and economies, the pressure is on to improve internal controls and workflows and ensure transparent financial reporting. It’s not just about accuracy; it’s about proving that accuracy to stakeholders.

- Increase transparency: Ensure performance metrics are communicated clearly across all departments. This helps everyone understand their role in achieving company goals

- Prepare for the upcoming budget year: Transparent reporting processes helps all employees, not just top executives, understand what success looks like

Howard Thompson, Global Financial Controller at GDS Group, shares how his team have managed to bring transparent reporting to life with our solution:

As we have all of our expenses coded up to project codes in the Payhawk solution, we can now report on our margins by event and so on at the end of each month. Payhawk has done a great job of ensuring that we can get that custom field from NetSuite and the project code from NetSuite into Payhawk.

Boost productivity through automation

CFOs are constantly seeking ways to increase efficiency. Automation is key to saving time and boosting organizational agility, leading to greater profitability.

- Invest in automation software: At Payhawk, we integrate with vital applications (e.g., NetSuite, QuickBooks) to enhance efficiency and financial governance

- Reduce manual tasks: Automate processes such as subscription tracking, expense reimbursements, and company spending visibility. This frees up time for strategic initiatives like revenue growth or cost savings

Alexander Sakakushev, Head of finance at Plan A, says:

Since using Payhawk, we [Plan A] have saved two days of manual admin per month through the solution's automation and AI!

Refine budget allocations

As a finance professional, you know that budgeting is truly more “art than science”, especially if you’re based in a growing mid-market company with many moving parts. Accurate planning is challenging but crucial for maintaining efficiency and profitability.

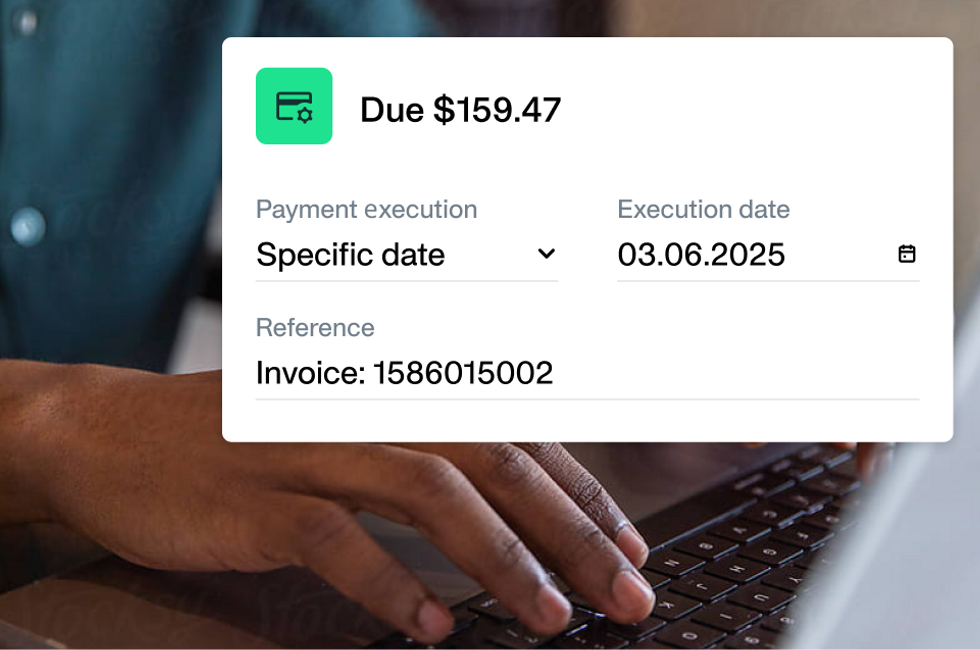

Use budgeting software: Tools like ours (combined with an ERP or accounting software solution) help finance teams simplify budget creation for different departments with categories and custom fields. We also offer corporate cards to track expenses and monitor spending.

Uchenna, Finance Manager at MDM Props, says:

Each cardholder codes up the job themselves to see where their costs are going. This is important because it keeps all the information in one place and pulls all the project budget spend info together to see what we can improve. Also, we now have the time to proactively do project analysis because we’re no longer chasing receipts!

Focus on strategic planning and forecasting

Even with an improving economic outlook (than over the past two years), uncertainties remain. As a financial leader, you must balance big-picture thinking with nimble responses to market changes.

- Prepare for economic uncertainties: Ensure you have enough reserves to handle potential risks. Focus on both revenue growth and maintaining profitability by controlling costs.

Konstantin Dzhengozov, CFO at Payhawk says in The CFO agenda: Unlocking growth without compromise:

The main issue companies face is the route to profitability. Interest rates are high and forecast to stay high, at least for the foreseeable future. [As such], each quarter we assess all the different tools that we’re using before we renew a software subscription. We carry out a very deep dive internally and ask, are we using this? Do we need it? Is there an alternative supplier that can provide the same thing at a cheaper cost? We’re really obsessed with subscription spend because it’s a very big expense for us and for a lot of companies nowadays.

- Implement proactive zero-based budgeting: Justify every expense before you renew. This method provides an objective way to evaluate spending based on actual performance rather than projections.

Your next steps

Assessing and implementing budgets and tackling over spend (and under spend) can be both challenging and rewarding. But mid-year is the perfect time to reassess your plans and make adjustments to ensure success for the rest of 2024.

At Payhawk, our solution can increase your visibility into your business operations, providing real-time data to track costs and spending and allowing you to make more informed decisions.

And you know what else? If you have budget left to spend, we might be just the purchase you need. At Payhawk, our average customer reaches ROI with Payhawk in just ten months (according to G2 data). Plus you can expect to save anywhere from two hours a day to four days a week. UK and European entities also benefit significantly from accurate VAT reclaims through precise receipt capture, leading to savings ranging from 250K a quarter to over 2 million a year.

Find out how our spend management software can help you refine your business budget for the rest of the year. Book a personalised expert demo today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Recurring expenses: The silent cash drain you can’t ignore