How to master real-time reconciliations

Reconciliation is an important task for finance teams. It helps you ensure that the financial data in your chosen ERP system matches your third-party audit evidence. So far, so straightforward.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

The problem is that card reconciliation is anything but straightforward for most businesses. London-based art fabrication company, MDM Props, told us that before moving to Payhawk for spend management, manually reconciling (including chasing receipts) used to take them 32 hours a week. That’s four working days!

The issues arise when the finance team can’t match the two sets of records for a number of reasons.

- People have used personal cards so it’s hard to track down payment details

- Colleagues have used corporate cards but haven’t kept any receipts as proof

- Supplier invoices have been paid but the invoice hasn’t been saved anywhere

- An expense has occurred without approval and now sits in limbo

When reconciliation goes wrong

Issues with missing and disparate information are just the beginning. If you’re working in a finance team without a spend management solution (or with multiple disconnected solutions), you might find that the real work begins once you’ve finally gathered all of the missing paperwork. Now, you have to manually enter the data into your accounting software or ERP to ensure that it’s properly updated. This will take days. And that’s before you’ve even matched the records.

- You can’t start processing month end until you’ve completed all your key reconciliations either, including:

- Bank Reconciliation - Accounting System to Bank Statement

- Aged Creditors Listing - Accounting System to Supplier Statements

- Aged Debtors Listing - Accounting System to Custom Remittances/payments. Invoices to signed contracts

- Intercompany reconciliation (to cancel out on consolidation)

The solution?

Businesses need to 1) capture data easily and 2) seamlessly sync it with the ERP or accounting software in order to save time and get perfect real-time visibility.

At Payhawk, we do both. Our software includes clever OCR technology that captures receipt and invoice data in seconds. And our superior integrations connect our solution with your accounting software or ERP of choice.

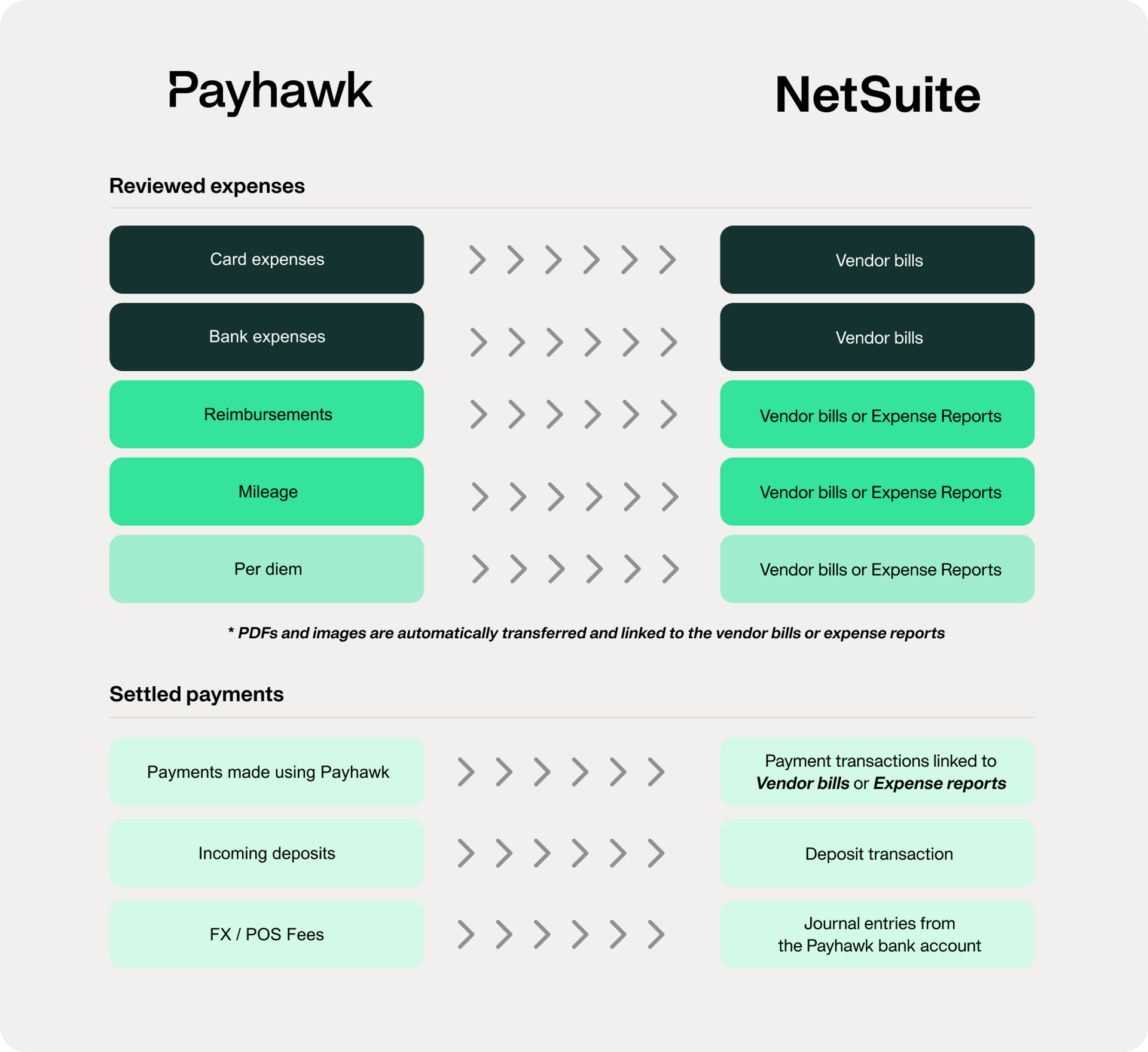

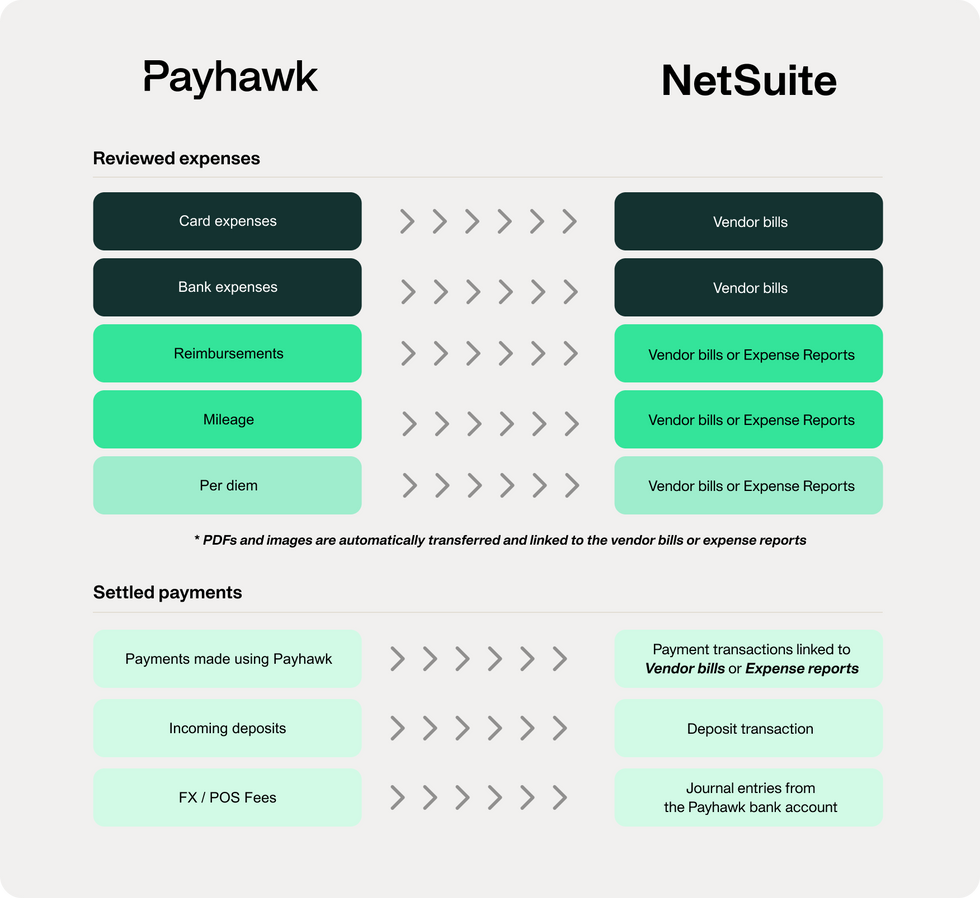

Our direct integration with NetSuite for example, follows our unique integration strategy which prioritizes seamless data synchronization to save our customers hours, and even days. The integration operates in accordance with the accruals concept by differentiating between the invoice/receipt and payment recognition dates, which means more accuracy and less work for our customers.

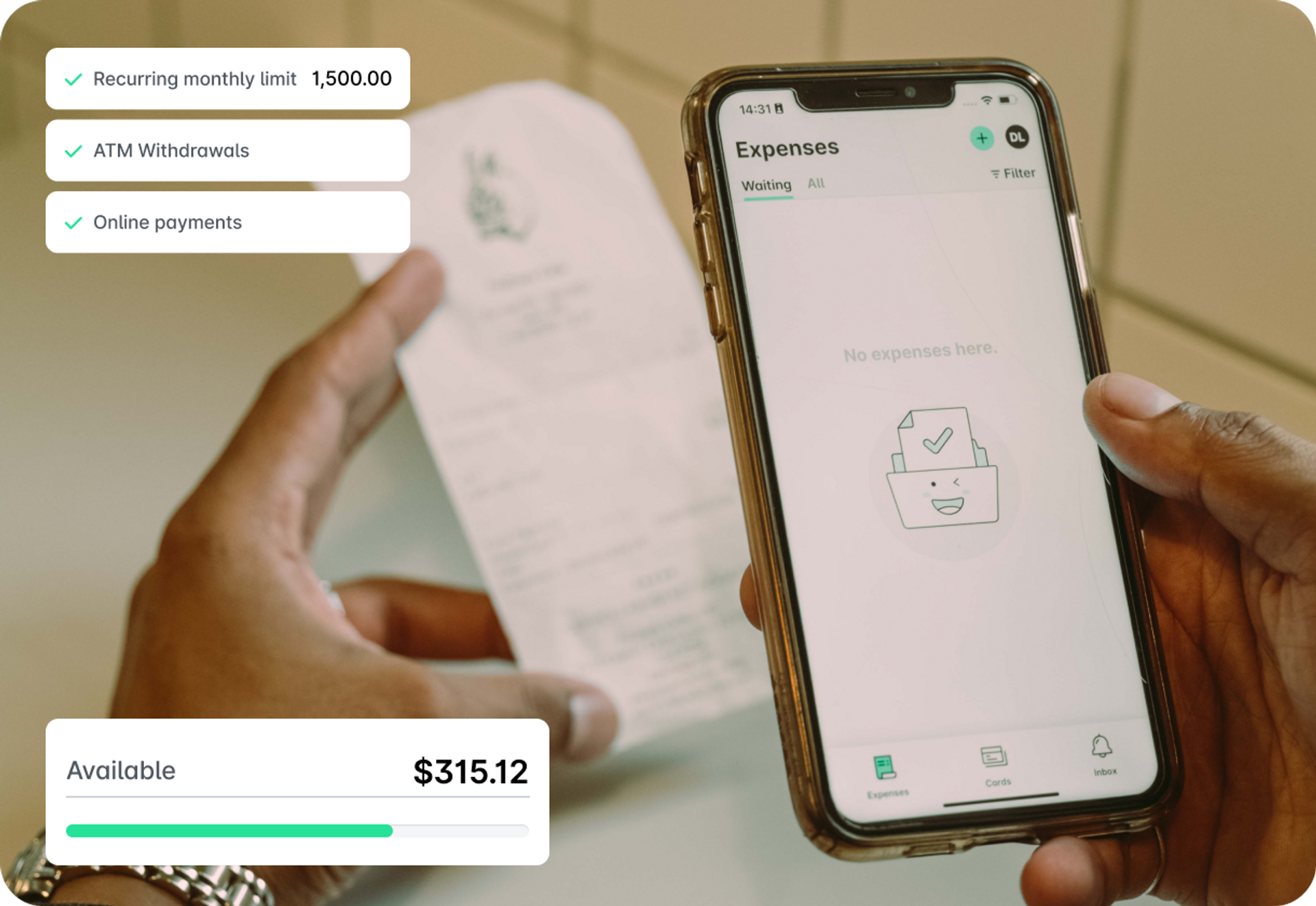

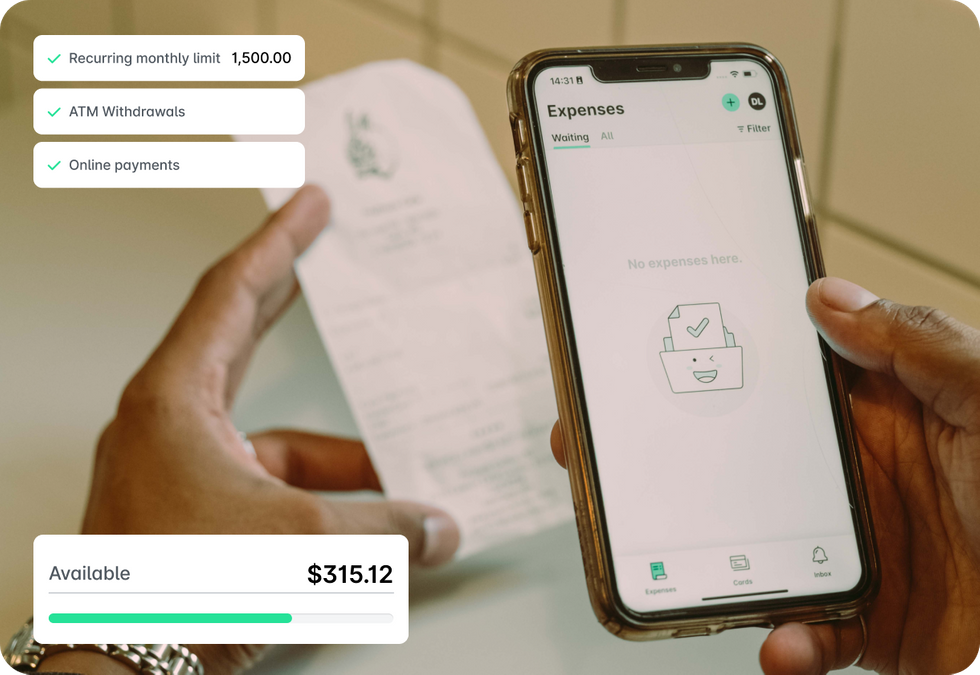

In addition to the advanced OCR capabilities and ERP and accounting integrations, Payhawk further simplifies expense management through real-time card feeds and card-linking technology. Your business can choose to use a Payhawk corporate card or link its existing ones.

By linking your existing corporate credit cards directly to our platform, every transaction is captured instantaneously. This means no more keeping physical receipts or submitting expenses manually. As soon as a purchase is made, the transaction details are automatically fed into the system, categorized, and ready for reconciliation. This real-time data integration not only eliminates delays but also ensures that all expenses are accurately recorded and categorized, streamlining the reconciliation process with your ERP systems, irrespective of the provider. This seamless connection empowers businesses to submit expenses on the spot and facilitates automatic expense categorization, drastically reducing manual efforts and speeding up the entire reconciliation cycle.

The Payhawk Visa Credit Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. for Visa cards. This is not a deposit product.

Seamless synchronization with ERP/accounting software

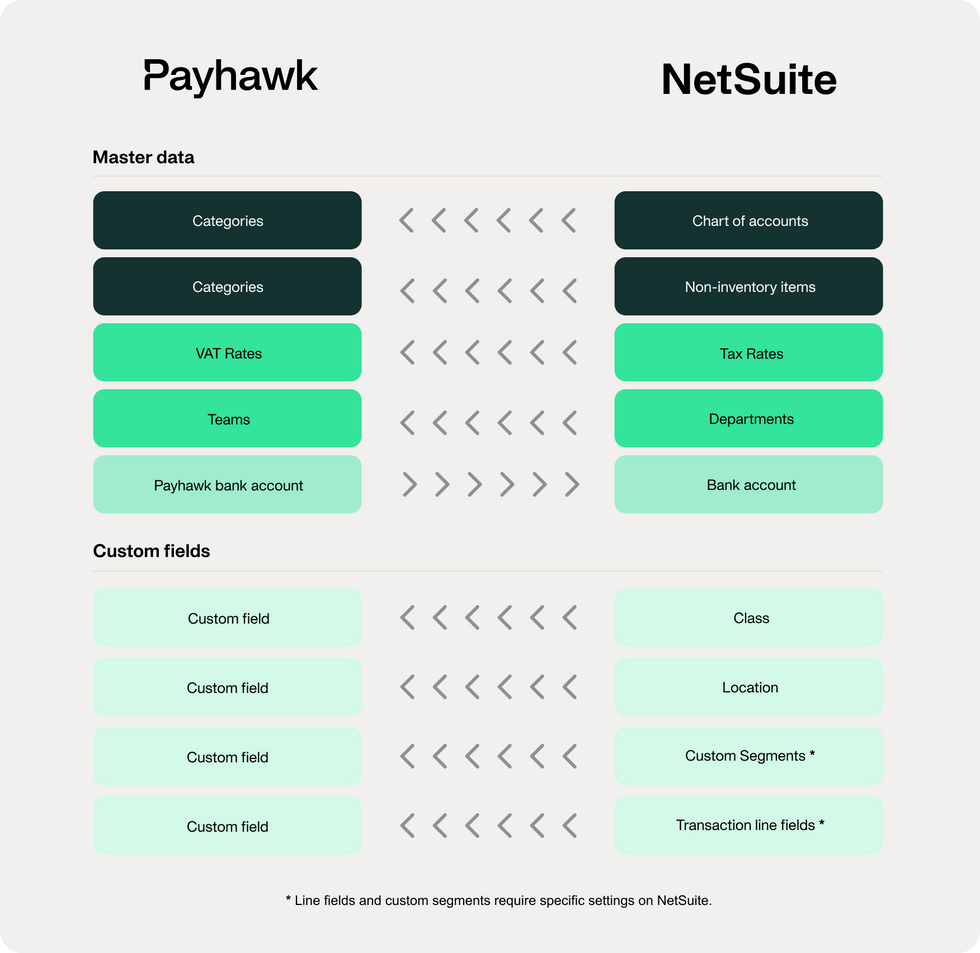

With Payhawk, all of your relevant accounting fields are set up and synced to NetSuite automatically.

For customers getting connected is simple. Once they connect their NetSuite subsidiary to Payhawk they can:

- Synchronise their chart of accounts, VAT Rates, departments, and classifications

- Create bank accounts in NetSuite for every active currency

- Create Payhawk General and Fees accounts

- Sync Payhawk and NetSuite balances from a specific date

- Utilize automated expense reconciliation to push payments and reconcile expenses instantly.

Export expenses automatically

We also export expenses automatically when they are marked as reviewed and export payments automatically when they are cleared or settled by the bank. Everything syncs seamlessly, saving time and effort.

Customers can set up Payhawk with NetSuite as they need using four key configurations; they can:

- Choose how to export reimbursements (expense reports or vendor bills)

- Select direct posting in the GL accounts or Non-inventory items

- Create or map Payhawk wallets to NetSuite bank accounts

- Choose which account to use for FX & ATM Fees. (Additionally, Payhawk creates a suspense account (Payhawk General) used whenever the mapping gets broken

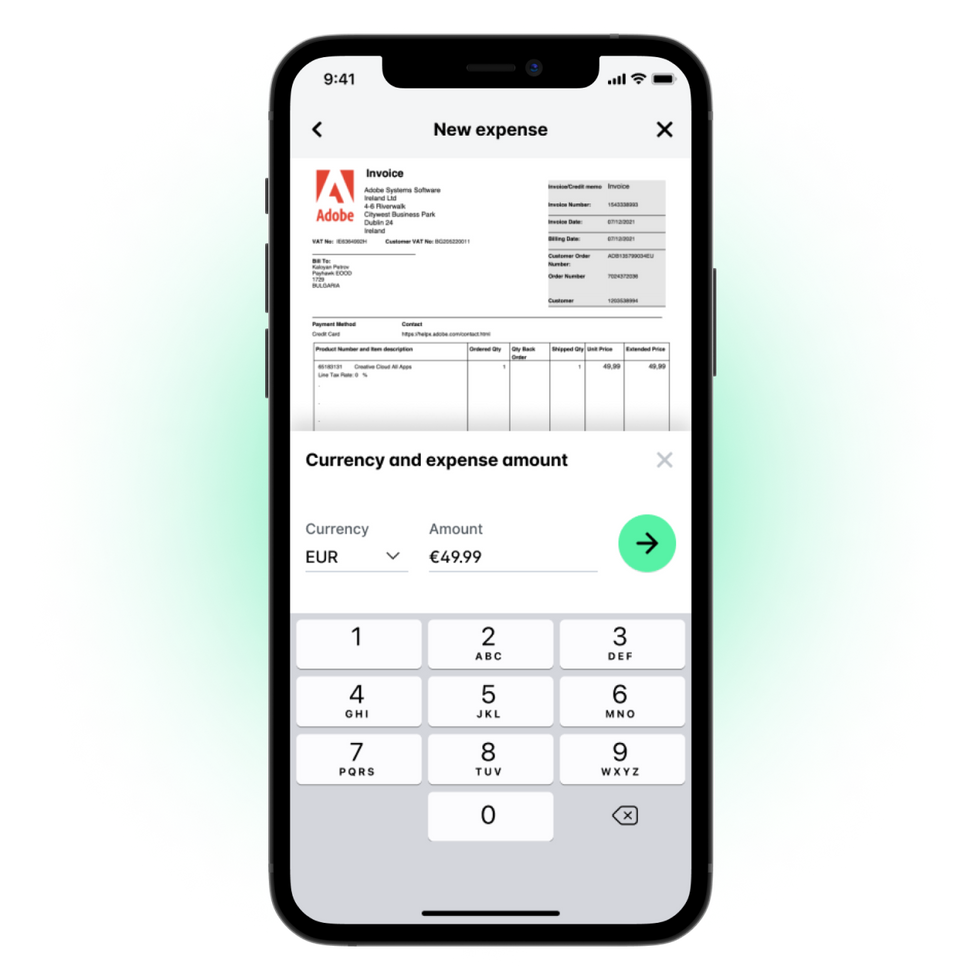

OCR technology for seamless scanning, processing and saving of invoices

The optical character recognition or optical character reader (OCR) technology is data extraction made simple. It means that your cardholders can simply spend with their Payhawk card, take a photo of a receipt or upload a PDF invoice and the OCR will pull all of the relevant information out meaning there’s no tedious data entry for you and your finance team. What’s more, we work with the Google OCR so that we can read data in +65 languages, including Cyrillic.

We extract each of the following with the OCR capture:

- Supplier name

- Date

- Due date

- Country

- VAT number (if relevant)

- Amount

- VAT amount (if relevant)

What about missing receipts?

Has someone forgotten to upload their receipt into the app? Missing receipts cause big headaches at the end of the month and make real-time reconciliation impossible. In the case of missing receipts, the Payhawk solution will automatically chase them to upload the missing information, saving the finance team even more time and effort.

And these missing receipts are a big deal. As Mathias Goetz, Senior Project Manager at ATU in Germany explained:

"We no longer have to chase receipts. Since using Payhawk, managers must simply take a picture of their receipt — thus digitizing it — and enter it into the automated finance system. In the first year, this change resulted in ATU recouping € 2 million from the tax office that would have otherwise been lost."

Keep your data flowing from first tap to month end.

Revolutionary real-time reconciliations

If your reconciliations are still taking 32 hours a week, then we should talk. CFO, Giancarlo Bruni at London HQ’ed e-commerce company Heroes puts it best:

"Could we live without expense management and an ERP? Well, yes, but it would be like driving a 30-year-old car on its last legs — no comfort, no good experience, and definitely no speed. Maybe some businesses are happy to have a back office with 25 people punching in numbers, but it's not efficient, fast, or necessary. We prefer to automate, integrate, and save money on headcount!"

Save time and improve visibility and decision-making with real-time reconciliation. And direct your headcount to something more beneficial than 'punching in numbers.' Book a demo to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Why you should integrate Dynamics 365 Business Central with Payhawk