Spend management from Payhawk: A guide to implementation

Managing change doesn't have to be complicated. If you're thinking about upgrading your spend management solution but worried about what the timelines and training might involve, we're here to demystify the whole process.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Change management can scare even the best leaders away from making decisions regarding processes, choosing the right software, and more. In a recent report, nearly half of companies (41%) said they haven't switched spend management solutions due to "resistance to change".

But change doesn't have to be complicated, and with the right implementation plan and support, your team can feel the benefits of moving spend management solutions fast. At Payhawk, our customers often capture ROI after just ten months, which is considerably faster than many competitors (G2, 2023).

We interviewed our Director of Implementation, Martin Reindl, to find out more about a typical implementation journey with Payhawk and what to expect.

Unlock better financial controls: Explore expense management with Payhawk

What is the typical timeline for implementing the Payhawk spend management solution?

"It depends; with some customers, it takes 15-20 days for us to complete the technical activation and implement the solution. That means 15-20 days of implementation work for us and 2-3 calls with the customer.

However, it may take longer for bigger customers with a more complex setup. Here, we partner in facilitating phased roll-outs and enablement for their teams, etc. and stay and support the client until they're ready to sign off, which typically takes a little more time."

Can you provide a detailed overview of the implementation process?

"At Payhawk, we're pleased to partner with our customers throughout the implementation process. Our shared goal is their success on the Payhawk platform, and we want to ensure they get the absolute most out of the solution.

We start with a welcome call where we design a project plan and go through pain points and goals. It's about half an hour, and it helps us get to know each other.

Then, we plan a technical kick-off call (usually the next day) to look at the account setup. Here, we go through everything from the accounting and finance setup and the GL account structure to connecting the relevant integrations, including the ERP. Then, we look at the user setup, including card policies, approval workflows, and organisational structure.

Then we do another call (or as many as the customer wants), and within this, we:

- Demonstrate the product capabilities and help customers to use the product to its full potential

- Share our recommendations for setup

- Ask the customer what they think of the plan

Based on their feedback, we either test it or rework it. We do the actual setup in the call, and afterwards, the customer can start testing.

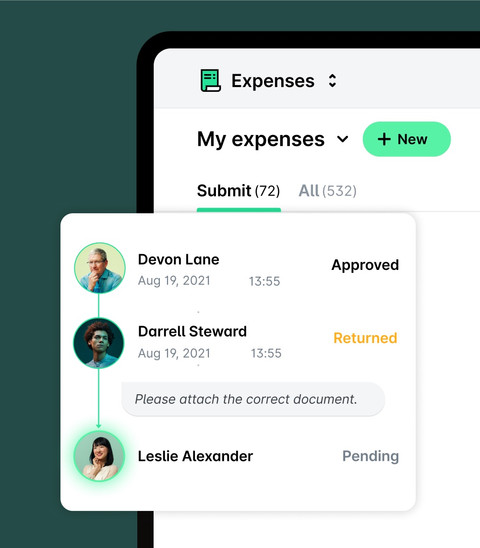

Once the customer approves the technical setup, we roll out the solution, inviting users and creating corporate cards. At Payhawk, we're built to be a very intuitive system and have excellent user reviews on G2. Even so, we're always there to guide the customer, offering live training sessions to staff to help them understand how to use Payhawk with zero delays."

What resources and support will be required from a customer’s finance team during implementation?

"Number one, the customer's finance team must have the right stakeholders on the calls. If they want to set up an SSO, for example, then we need the tech admin on a call. And if they have an external accountant working on an ERP, we need them on the call, too.

We ask the customer to bring documentation on rules and policies, and we go through a checklist of questions to make sure we have everything we need to get them set up effectively.

Our implementation managers and project team are almost like Payhawk consultants; they're here to guide and advise on setting up the company account and do the heavy lifting so the customer is prepped for success.

We then look at their use case and offer suggestions and advice on setting the solution up to ensure they get the biggest bang for their buck. Take, for example, a customer who says they don't need our subscription management software. In that case, we still suggest setting it up based on our research into their use case, as we've seen that it would benefit them and offer even more value.

During implementation, we also ask customers to fill in a 'bulk import template' where they can put users, cards, VAT rates, custom fields, values, etc. We use this information to configure their integration accurately from the beginning with all the important master data.

How do you handle data migration from the customer’s current system to the Payhawk platform?

“For data migration, we look at three things:

- The native integration to ERP systems for accounting information. By connecting the ERP system, we can sync all accounting categories, custom fields and values, VAT rates, and vendors directly from the ERP.

- The template I mentioned above supports non-native integrations or extra info.

- And our HRIS integrations which ensure all the employee info is added and employees have the right access to the system as long as they are part of the organisation.”

What level of training and support is provided to a new customer’s team during and after implementation?

“During implementation, we ensure all key users (accountants, etc.) know how to navigate Payhawk. These sessions are also Q&As so we can go into depth to uncover their needs.

After the technical setup has been signed off, we go into a ‘hyper-care phase’ to ensure the rollout is as smooth as possible. We offer approximately half an hour of user training that guides them through Payhawk, including the app and web platform.

Plus, we have extensive help centre articles, guides on getting started, an implementation guide, and more — with content for end users, admins, and accountants.”

What challenges have other organisations faced during implementation, and how were they addressed?

“Sometimes mid to big corporations purchase Payhawk to simplify spend management and replace clunky but very embedded existing processes.

Here, we go super deep with clients to check on the current process, the current pains, the existing solution architecture, and how we can help adjust the process to save them as much time as possible.

For some companies, this is the first wave of digital transformation, and introducing Payhawk means modernising and potentially simplifying processes, thus saving hours and even days. While for those going through a second wave of digital transformation, it’s more about getting a single place to manage and assess spend (instead of switching between multiple disconnect tools).

Either way, we’re used to seeing companies with embedded processes and tools, and used to giving them everything they need during implementation to ensure they’re set up to save time, take complete control of spend, and hit the ground running.”

How flexible is the Payhawk system in accommodating specific finance policies and workflows?

“The system supports flexibility. We allow a lot of customisation while still being user-friendly. We’re constantly improving our workflow-building capabilities to allow for more customisation, and we support individual requirements with advanced card controls, automation, and more. We can enable approvals based on team structure, cost centres, roles, etc.

It’s not a ‘bespoke’ solution, but instead, we’ve worked hard to improve and automate many rigid and / or manual processes. We help customers set up so that they can support company policies and workflows in an efficient and digitised way with customisable controls, workflows, spend categories, and more.

What ongoing support and communication can customers expect post-implementation?

"Our Support Team helps ensure a clean rollout. The team is excellent if there are technical or how-to questions, offering multilingual advice and support in under a minute (and available on all plans). Our online help centre is full of really helpful articles, too.

Plus, our customers have lots of support. The team is always there to respond to feedback (including inputs and ideas, new feature wishlists, and more) and ensure customers understand new features and are aware of any exciting opportunities or technical updates."

What singles out the Payhawk ERP and accounting integrations implementation as superior?

"First, it's the way integrations are built. Our integrations and how we've built our APIs ensure a holistic data transfer into the respective systems in many ways, from set-up to month-end. For example, they automate master data sync between both systems, setting you up for a global unified accounting setup without needing to import each GL account individually.

Also, it's really the automation factor. All of the pre-accounting happens in Payhawk with our in-product intelligence features and OCR doing the heavy lifting, leaving approvals and reviews to the respective roles and users. To facilitate real-time reconciliations and a much smoother month-end, Payhawk syncs transactions once they are settled and the respective expenses — once they are reviewed in the portal.

Another thing: even for clients without integrations, we offer an API with the appropriate documentation so they can build their own. We also offer accounting templates for dozens of ERPs and accounting systems that allow for a similar experience, resulting in an export of all transactions, expenses and payment documents, formatted for their accounting system, that customers can easily download."

Which type of enterprise software is the easiest to set up?

"Payhawk is very easy to set up thanks to:

a) our experienced team

b) bulk import processes

We ensure no time is wasted on manual data entry! Yes, we have a checklist, but it's important for us to work as per the client's specific challenges and goals. We want the customer to feel the benefit they've highlighted quickly and effectively, so we prioritise this highly.

And it's working: In 2023, G2 showed we had an average of ten months to ROI, which is much faster than the industry average."

Want to experience our lightning ROI rate for yourself? Save time on manual admin? And close your month twice as fast? Book a personalised demo to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Best ZipHQ alternatives for Mid-Market Finance Teams