What are cross-border payments and how do they work?

If you’ve been hunting for a more cost-effective way to send and receive international B2B payments, cross-border payments could be the answer. It’s time to ditch cheques and lengthy, expensive bank processes and embrace faster cheaper cross-border payments.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

B2B payments are monetary transactions between two businesses rather than between a company and a consumer (B2C). B2B payments play an essential role in your business — with faster processing times, B2B payments can remove the friction associated with doing business both domestically and across borders.

If you’re in the B2B industry and looking for more information about different B2B payment methods and want to explore different trends taking the B2B payment industry by storm, including real-time payments and cross-border business payments, then keep reading.

Get faster, more cost-effective global payments

What are cross-border payments?

Cross-border or international payments are when the payer and the payee are based in different countries.

If you manage your cross-border payments through a bank, it costs you more and takes you longer. UK newspaper The Telegraph reports, "High-street banks typically have high currency transfer charges of up to £30 per transaction." While Wise Platform shares that if you request a transfer before your bank's cut-off date, you can expect an international wire transfer to take approx' 1-5 business days, with payments getting dragged out further by further compliance checks and more.

But if you use money transfer services or spend management platforms with integrated transfer services to make your international B2B payments, for example. You'll find it's a much quicker and cheaper option. They offer more flexibility when choosing payment methods, including digital and mobile wallets.

How do cross-border payments work?

Making a cross-border payment is more complex than transferring funds from one bank account to another, like domestic payments. If you’re using a bank, it’s much longer-winded — the paying business first gets their bank to transfer the funds to its equivalent bank in the seller’s country; if the seller has an account with the bank, they can receive funds directly.

If the seller doesn’t have an account with the bank in question, the funds are first transferred to the seller’s bank before being transferred to the seller’s bank account.

But when using a global spend management solution featuring an in-built international payment system like Payhawk, not only can we ensure your rates are more competitive against banks, but your local payments are free. Plus, our borderless corporate cards mean you can easily make global payments in multiple currencies, including USD, EUR and GBP.

With dedicated IBANs via digital wallets or credit or debit cards, you can send payments to suppliers and employees worldwide without the long-drawn-out process you can face with traditional banks. And, what’s more, over 46 million merchants accept our corporate Visa cards.

Benefits of cross-border payments for B2B companies

Your customers and suppliers don’t just have to be from your local area — they can come from anywhere. Manufacturers, suppliers, and customers scour the internet for the best-fit product regardless of location. For example, if you’re a manufacturer based in the UK but purchase your raw materials from Germany, you’d benefit from cost-effective cross-border business payments.

By utilising cross-border payments, your business has access to many more markets, which means your chances of scaling and growing your business are much greater. A more cost-effective way to process international B2B payments means you’re cutting costs which can be spent elsewhere in the organisation.

Efficiently processing your B2B international payments isn’t just beneficial for your business by saving time and admin costs; you’re also improving your relationship with your suppliers and customers by providing a quicker way of transferring payments.

What’s driving the growth of international B2B payments?

Digital infrastructure has made it much easier for businesses to find and work with other businesses around the globe. As a result, fintech companies created new payment solutions to offer a faster and more flexible way to pay internationally.

And with businesses increasingly looking further afield for materials, goods and services, the need for digitisation has only grown. These businesses demand simplistic integrated payment solutions to help them expand effortlessly while minimising data errors and administrative burdens and increasing efficiency, visibility and scalability.

As these payment solutions crop up, businesses are growing in confidence to switch from traditional banks to alternative financial institutions.

The challenges of accepting cross-border payments

Many companies find it challenging to send and receive international payments, but with digital solutions (like Payhawk), it can be simple. Here are some common challenges being faced by CFOs today.

- Hidden fees and costs — making payments in multiple currencies can bring a whole host of costs, including transaction fees and unfavourable exchange rates, which soon add up

- Differing payment methods — Different countries may prefer one payment method over another. This means you can't offer each customer a consistent and frictionless payment experience

- Slower transfers — Managing cross-border payments through banks can be a slow, drawn-out process. Payments can take up to five days to land in the recipient's account

Six types of B2B payment methods

You might process your payments in several ways; here are six of the most common methods.

1. Cheques

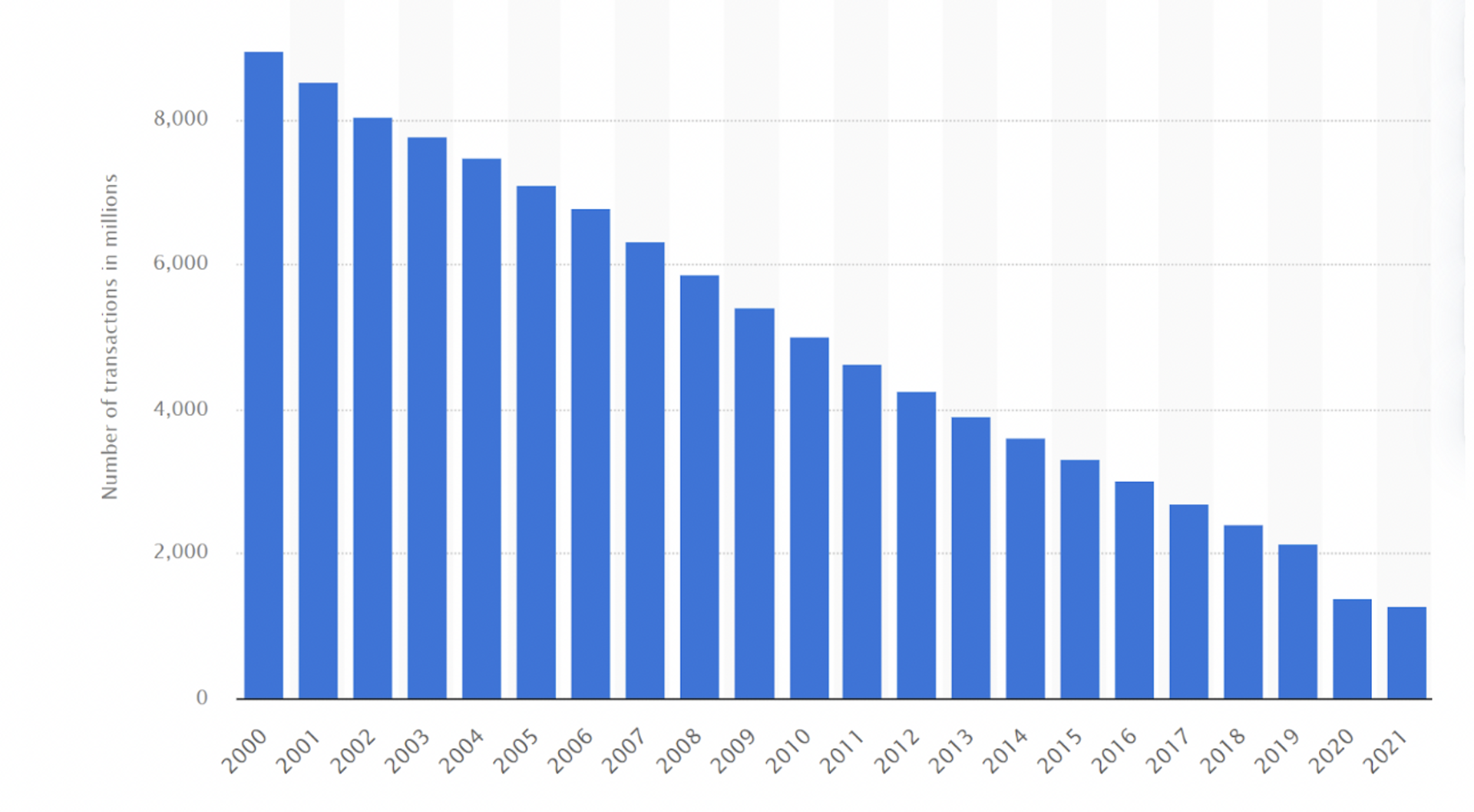

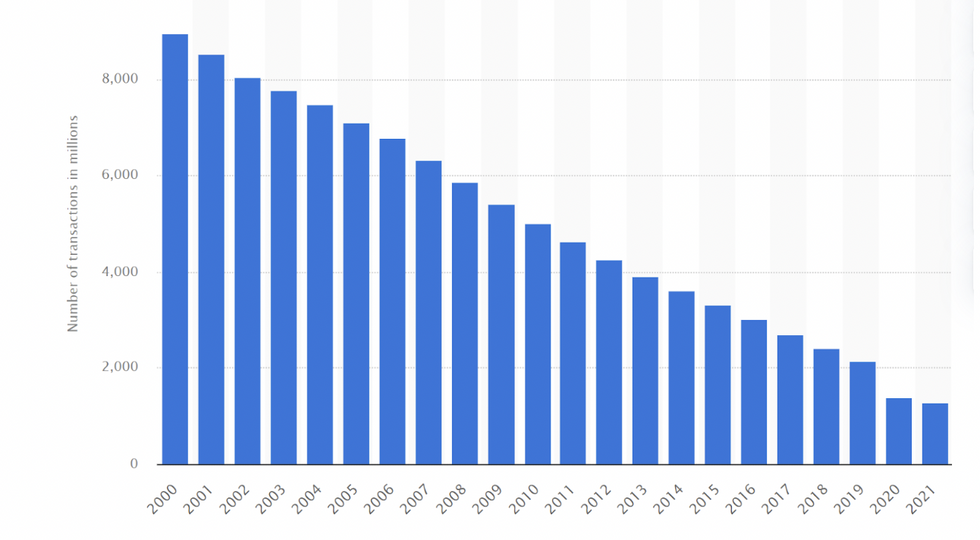

Although they're still used as a B2B payment method, they're not as popular in the UK and Europe as in the US. The number of cheque payments processed in the European Union has steadily declined over the last twenty years.

Although checks usually take just one working day to clear, the process of cashing a cheque needs to be more efficient for modern businesses to move money fast.

2. Bank and wire transfers

A bank transfer is also known by the abbreviation BACS and can be known as a way for businesses to make direct payments from one bank account to another, usually in the same country.

Meanwhile, SWIFT transfers power many international transfers between banks using SWIFT

codes.

A bank transfer is also known by the abbreviation BACS and can be known as a way for businesses to make direct payments from one bank account to another, usually in the same country.

Meanwhile, SWIFT transfers power many international transfers between banks using SWIFT codes.

Finally, a wire transfer involves moving money from one bank to another, with the bank serving as an intermediary. It's an electronic payment method where the sender sends funds to their bank, which then transfers the money to the recipient's bank and ultimately to the recipient.

3. Credit cards

Credit cards are a convenient way to manage your business finances. They’re usually on a revolving line of credit, making it easier to dip in and out of to make unexpected B2B payments. The reward schemes, cash back, and cash flow control that come with credit cards also make having them exceptionally worthwhile to many businesses.

4. Cash

Cash is the oldest B2B payment method, but it’s risky as there’s no electronic transaction record. This makes it incredibly difficult for your business to manage money effectively, as there’s no digital visibility.

5. Digital wallets

Digital wallets are an increasingly popular way to manage your business’s money, particularly for overseeing employee expenses. Accessing a digital wallet is easy, making payments effortless on the go.

At Payhawk, you can add your cards to virtual wallets, too, making controlled spending on the go faster and easier.

6. Virtual cards

With virtual cards, you can cap spending limits to regain control over spend and reduce the risk of fraudulent transactions. You can use these cards to automate B2B payments and the entire expense reporting process. All this increases financial transparency.

Plus, with a solution like ours, you can set up virtual cards for your employees instantly via our app, making the employee and finance team experience much smoother.

Source: Statista. The number of payments made with cheques in the European Union from 2000 to 2021.

Ten eye-opening B2B payment statistics

1. Processing international B2B payments takes 55% longer than domestic payments

According to research, domestic B2B payments took an average of 21 days to be received, while cross-border business payments took 32 days, an enormous 55% longer.

Waiting for delayed cross-border payments disrupts business and makes it harder to predict cash flow and plan budgets accurately. So it's a lose-lose all round.

2. The global B2B payments market is predicted to grow by 10.10% from 2022 to 2030

The global B2B payments market is witnessing rapid growth. In 2022, the market was valued at USD 994.20 billion, a figure predicted to increase by 10.10% by 2030. Why is the market growing so fast? With companies adopting digital payment methods, including digital wallets, online banking and mobile payments, B2B payments have never been easier to make, receive and manage; demand is also growing for international trade and for simpler, automated payment systems.

3. 42% of B2B payments are made by cheque

Even though more and more businesses are embracing the digitisation of payments, there is still a large proportion of companies making payments using cheques. This process is very slow and admin-heavy but easily fixable with modernised payment solutions. And there’s a vast disparity between the B2C and B2B markets, with the B2C industries storming ahead and embracing modernisation, with 71% of B2C payments being electronic.

4. EUR and USD make up seven out of 10 SWIFT payments globally in 2023

If you’re hoping to expand your organisation beyond your home soil, you’ll need to get ready to pay in Euros or U.S. dollars at some point. According to research from Statista, Euros and USD were the most common currencies used to make global SWIFT payments in 2023.

At Payhawk, we offer multi-currency support to make cross-border payments directly through the platform. That means we can provide you with payment accounts in USD, GBP and EUR, helping you hold funds in multiple currencies, so if you’re looking to simplify global operations, save money or expand globally — we could be a pretty good fit.

5. 28% of companies are processing B2B payment transactions manually

Automation has completely changed how finance teams manage company spending, from expense management to simplifying B2B transactions. However, data suggests that most companies are utilising B2B payment automation, but 28% of companies still don’t.

Automation streamlines everything; you can reconcile your accounts immediately with automation, simplify B2B transactions with our virtual company cards, pay your bills with one click, and automate expense approval requests. The list continues.

Without automation, businesses are missing out on the bigger picture. Automation allows businesses to increase innovation, reduce payment costs, and improve fund management.

6. Three in four small businesses aren’t happy with cross-border payment solutions

That’s according to collaborative research from PYMNTS and Payoneer. Without suitable international solutions, you limit company reach and impact customer experience. That’s why finding an international payment solution that closely matches your business’s needs is essential.

You need to find a cross-border payment solution that delivers continuous value and consistently innovates to deliver the best-in-class solutions on the market, like Payhawk.

7. In 2020, UK businesses exported over £308 billion worth of goods

If you don’t have a comprehensive international payments strategy, not only could you be missing out on cost savings through currency exchange rates, but you could be leaving money on the table when it comes to international sales.

UK businesses exported over £308 billion worth of goods in 2020, so it’s clear that companies can make money if they can find a way to process transactions quickly and efficiently.

8. Cheques and ACH debits are most susceptible to payment fraud activities

According to the AFP 2022 Payments Fraud and Control Report, financial professionals stated both cheques and ACH debits were the payment methods most impacted by payment fraud.

Therefore, it's essential to make these payments through a secure, intelligent environment that can verify payment details before they are made. Robust approval workflows based on different payment thresholds will also help reduce the risk of large sums of money being subject to fraud.

9. Since Covid, 55% of CFOs are now using virtual cards and embracing innovation

Covid pressed fast-forward on digital innovation for many businesses, particularly regarding spend management. Being able to track expenses and B2B payments from the office or at home empowers enterprises to take control of their spending on the go.

Virtual cards also offer a degree of automation you don't get with other payment methods. You can automate payments, whether they're recurring or ad-hoc, which means the time previously spent managing these tasks manually is a thing of the past. That's, in part, why over half of CFOs surveyed are now utilising virtual cards post-pandemic.

How to choose an international payment system

If you're looking for a compatible payment system to support your international business expansion, here are some things you should consider:

- Make sure the international payment system you choose offers various payment methods. At Payhawk, we support credit and debit card payments from digital wallets, invoice payments, and more. Finding a system that can support the methods you want to use is crucial; various options give you flexibility when making and receiving international payments

- Ensure the international payment system complies with regulations and has high-security standards. Payhawk is PCI compliant, which means all our customers' credit and debit card data is protected, always. We also comply with anti-terrorism and money laundering regulations

- Check that the system supports the currencies you need to transact. We offer our customers dedicated IBANs in multiple currencies, including GBP, EUR and USD. Directly from the Payhawk platform, you can now make international payments in 50+ currencies in 160 countries*

- Find a system that seamlessly integrates with leading ERP and accounting software. Payhawk integrates with ERP, accounting, and business travel tools like TravelPerk, NetSuite, QuickBooks, Xero, and Microsoft Dynamics. If you don't use any of them, don't worry; our Developer APIs can build custom integrations, too

- Be aware of the fees they charge you, and be on the lookout for transaction, monthly and currency conversion fees. We're proud of our transparent pricing model and ensure there are no hidden fees

You need a solution that will be there to support you throughout your working relationship. We offer customer support through phone, email and live chat. So, if you just want to ask a question, we're here to help

The future of B2B payments

The innovation of B2B payments focuses on utilising emerging technologies that provide seamless, low-cost, cross-border payments within international payment management systems.

Smart APIs allow businesses to seamlessly incorporate global payment features into their ERP, accounting, and travel software, simplifying and enhancing the visibility of B2B payments.

At Payhawk, we offer a comprehensive international payment solution for customers to make payments in multiple currencies in multiple countries and manage these in a standardised way across multiple entities.

"Payhawk's international bank payments feature means we now have one platform to manage our payments, from employee reimbursements to paying suppliers across different currencies, including USD. We love that we don't have to switch between different providers to make payments and have a complete overview of spend in Payhawk."

— Simon Shohet, Finance and Strategy Senior Manager, Alma

Our smart software can deliver ultimate visibility, accuracy, compliance, and efficiency all through one platform. Plug your ERP and accounting software straight into the platform with our direct APIs and see your overall spend in a single group dashboard to help you effectively manage cash flow and business-wide financial reporting.

Schedule a demo to see our international payment system in action.

*Some currencies may not apply. For a complete list, please visit wise.com to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

How to lower accounts payable error rates with an automation software