The power of spend management: How ten top businesses transformed spend culture

Creating a strong spend culture is a game-changer for any business aiming to manage finances effectively and transparently. At its core? It’s about integrating financial policies into everyday operations, ensuring every penny or cent spent aligns with your company's strategic goals. Find out how ten top businesses have transformed their financial management and built robust spend cultures with the help of advanced spend management tools.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Building a strong, transparent spend culture will revolutionise your business's finances. It's not just about tracking expenses; it's about embedding financial policies and decision-making into your daily operations and rolling them up to your broader business culture, ensuring every pound, dollar, and cent supports your strategic goals.

Forbes Magazine describes spend culture as "a segment of a business's wider organisational culture consisting of shared beliefs, values, and practices that inform the how, why, and when of spending money within that business."

This blog explores how ten companies from various industries across the EEA, the UK, and the US have embraced technology to streamline their financial processes, improve accountability, and drive growth in an effort to create robust, transparent spend cultures.

Unlock flexible financial controls with Payhawk

Mastering spend culture: Tools and strategies for financial control and growth

Let’s assume you’re all in on the value of spend culture. Yes, you want to embed financial policies and decision-making into your daily operations and roll them up to your broader business culture. How can you help make this a reality?

Using advanced spend management tools is a huge part of bringing spend culture to life in business. They help companies like yours categorise expenses accurately, meaning you get detailed financial tracking and effective budget management. It's all about making sure the right people have the right information at their fingertips.

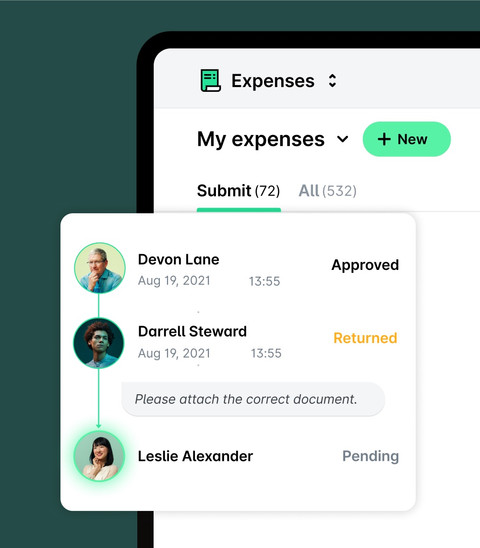

Empowering your employees to manage their own expenses and ensuring accountability is another big win. Giving people the tools to track and report their spending fosters transparency and accountability. Additionally, automating these processes reduces time-consuming manual work and improves decision-making with real-time financial visibility.

Customised approval processes and real-time spending insights are key, too. They keep everyone in check, ensuring that spending stays within policy limits. This approach helps you maintain complete spend control, even as your business grows, so you can focus on what's really important.

In short, building a strong spend culture isn't just good practice; it's essential for driving growth and maintaining financial health. With the right tools and a collaborative approach, your business can achieve greater financial control, enhance efficiency, and ensure that any and everything you spend helps you reach your goals.

At Payhawk, we've helped companies worldwide to make their spend cultures a reality. Here are insights from ten:

1. Empowering collaboration and efficiency at GDS

Howard Thompson, Global Financial Controller at digital events company GDS Group, highlights Payhawk's transformative impact on their financial processes.

The great thing about Payhawk is the amount of collaboration that now takes place between finance and the rest of the business. Payhawk has really helped finance move into an enablement role.

But what exactly is the impact of the above shift from a policing role to an enabling one? It allows the finance team to work more closely with other departments and helps foster a culture of financial responsibility and shared goals, building a culture of responsible accountability.

Hannah Dobson, VP of Sales at GDS, adds:

Payhawk has saved me time, but more importantly, it's saved my team time. It's a dream because now I can get my team to do their own expenses, and I can approve them from afar quickly and efficiently. It's a great user experience, and it means they can focus on higher-value activities.

By simplifying the expense management process, we've helped the GDS team free up valuable time for the finance team to focus on strategic initiatives, enhancing overall productivity.

2. Customisable controls at State of Play Hospitality

Meanwhile, at State of Play Hospitality, (a pioneer in technology-enhanced experiential leisure concepts), Andrew Jacobi, VP of US Finance, illustrates the importance of detailed financial tracking:

We really rely on the customisable class settings within Payhawk to distinguish between venues to analyse performance. We create the custom fields that our cardholders use to categorise their spend. So, whether it's categorising between venues or categorising it into the right general ledger code, it's extremely helpful in terms of how we allocate spend.

This approach has given the team two crucial things they were missing before: 1) Transparent, up-to-date spend data, and 2) employee accountability and visibility. Now, the team can see if they've forecasted accurately and where they need to make changes, helping support a culture of transparency and agility.

Andrew continues:

At the end of the period, we look at two things. First, were we able to forecast our spend properly? For this, we put Payhawk directly in the hands of our venue managers so they can report on what they're spending money on. This approach means they can track spend against their budget and ensure they meet it across each general ledger category. Then, at the end of the period, we look at variance to budget — seeing whether a spend category exceeded or came in under budget. Payhawk allows us to spot if there's overspending in specific places up and down our P&L very quickly.

By integrating spend management with real-time reporting and customisable fields, the State of Play team has enhanced its ability to monitor and control expenses, ensuring it meets its financial goals.

Watch their full story below:

3. Streamlining financial processes at multi-subsidiary business Wellpointe Inc

At Wellpointe Inc., co-founder, president, and CEO George Kutnerian emphasises how we have helped eliminate non-value-added activities in their accounting processes and empowered employees to track and record their spending correctly.

Payhawk helps us free up the accounting department from what I consider a 'non-value-add' activity. A good example is where we've empowered our spenders to code their own transactions with Payhawk. And when I say code, I don't mean they're just putting a note next to it; for us, our chart of accounts actually lives in Payhawk. And so anyone who's spending within Payhawk is empowered to leverage the chart of accounts and code the transaction appropriately.

This empowerment extends to ensuring transactions are coded correctly at the point of purchase, fostering a transparent and accountable spend culture.

Eventually, I want to get to the point where all spenders code expenses exactly at the point of purchase… and I've given the team a tool to reinforce that expectation and help us build a transparent spend culture.

4. Automating, integrating, and saving time at Heroes

For Giancarlo Bruni, CFO of the fast-growing e-commerce company Heroes, the spending culture must ladder up to the overall company culture, which involves agility and "pushing through obstacles to get things over the finish line." And Giancarlo and his team expect their chosen finance technology to help propel them to the next level here, especially when it comes to efficiency and lean processes.

Working without expense management and an ERP is like driving a 30-year-old car — no comfort and no speed. Some businesses have a back office with 25 people punching in numbers, but it's not efficient or necessary. We prefer to work with Payhawk to automate, integrate, and save money on headcount.

Visibility is key, too. And Giancarlo highlights the real-time financial visibility we provide thanks to our seamless integrations with NetSuite.

As a CFO, I want to know how much money and profit we have in real-time and what levers I need to pull. We also need to know about our stock, including when it's arriving, how much is in transit, and if we need more. I can see all of this via my ERP, plus I can see spending in real time thanks to the direct integration with my expense management software.

By automating and integrating financial processes, Heroes has improved efficiency and decision-making, ensuring they can stay ahead in a competitive market.

5. Enhancing control and visibility at Rentals United

Meanwhile, at Rentals United, CFO Javier Gorena describes how we've transformed their financial management, contributing to a stronger spend culture involving approval levels and customisable processes:

Yes, other tools can manage expenses. But nobody does it like Payhawk. With other spend management solutions, I felt blind about expenses, but Payhawk gives me all the control and visibility I need to make the best decisions.

Previously, Rentals United relied on manual processes that were slow and lacked visibility — but they knew there was a better way:

Before Payhawk? The procedures were manual, and there was little visibility in terms of spending or budget. Now, it's a different story. We love Payhawk as it adapts to our rules and needs. We can create departments or teams and implement a personalised spending approval process with various levels of approval depending on the amount we want to spend. This makes it much easier for us to stick to budgets and carry out our business strategy.

By implementing our solution, Rentals United has streamlined its expense management, ensured compliance with its spend policies, and enhanced a culture built around a balance of flexibility and control.

6. Supporting rapid growth at VICIO

Like Heroes, Finance Director at VICIO Adrià Vázquez shines a light on the importance of scalable processes for rapid growth. But how does a robust spend culture play into this growth?

When you aim to scale rapidly, all your processes must be really scalable. With Payhawk, we can maintain visibility and control over spend, even as the number of receipts and invoices multiplies. Now, I can't imagine the finance team working in any other way; thanks to technology, we can accomplish things faster and with zero errors.

Adria also underscores the importance of maintaining control and visibility over expenses and using technology to build a spend culture that perfectly balances freedom and control.

“I am confident that we have control of our expenses thanks to Payhawk's spend controls and real-time view of spend. Anything that slips out of policy could pose a risk to the company. But by maintaining a strong sense of control, we can evaluate the profitability of our actions and continually improve.”

It's not about controlling our team, as we have a highly capable group of professionals; it's about controlling the numbers to anticipate, prioritise, and focus on what truly matters.

By fostering a strong spending culture shaped by the popular idea of 'freedom within a framework,' VICIO ensures that its financial practices support its rapid growth while maintaining the integrity and profitability of its operations.

7. How Mercell enhances spend visibility and control

At the industry-leading procurement marketplace Mercell, the introduction of spend management tools has significantly transformed their financial processes, embedding a strong spend culture focused on accountability into their operations. Louis, Head of Buyer Marketing at Mercell Nederland, highlights the benefits:

Payhawk shows you the budget you can spend each month and how much you have spent so far so you know how much is still available. That was not the case before when we all used the same company card.

Louis's favourite feature is the ability to assign spend policies to employees, empowering them to manage their budgets independently:

I like it because it empowers employees to perform their job function without having to ask for permission to spend money that they have already budgeted.

This empowerment is a cornerstone of Mercell's robust spend culture, as it streamlines the approval process and ensures that spending aligns with company policies.

By integrating financial policies into everyday operations, Mercell has created an environment where employees are accountable and proactive in managing their budgets. And while the level of control and real-time visibility is essential for maintaining a transparent and effective spending culture, it is also essential to ensure that every expenditure supports the company's strategic goals.

8. ATU streamlines expense reporting and saves millions

German auto giant ATU had some major challenges with managing receipts and external purchases across more than 500 branches pre-Payhawk. The team at ATU knew it was vital to update these manual tasks, and their updated, efficiency-focused spend culture rolled up into a complete digital transformation process at the company.

Mathias Goetz, Senior Project Manager, explains:

We no longer have to chase receipts. Since using Payhawk, managers must simply take a picture of their receipt — thus digitising it (via OCR) — and enter it into the automated finance system. In the first year, this change resulted in ATU recouping €2 million from the tax office that would have otherwise been lost.

The streamlined process for handling external purchases has also reduced paperwork and overhead costs.

Before Payhawk, when buying parts from other companies in the sector, our branch managers would historically always reach for cash, generating a massive amount of paperwork. With Payhawk, we have a solution that lets us streamline processes and save on overhead costs.

Now, thanks to its shift towards a digital, streamlined approach, ATU has bolstered its spend culture, ensuring better financial tracking and compliance. By embedding these new policies and tools into its daily operations, ATU has reinforced a culture of transparency and efficiency, demonstrating how digital transformation can drive major improvements in financial and operational management.

9. Discordia ensures financial security and support for drivers

At Discordia, Bulgaria's large transportation and logistics company, the leadership team significantly improved financial support for its drivers using our solution. With a wider company culture that includes employee safety and support as a priority, it was essential for them to also find a balance between spend control and efficiency.

Petyo Kozarov, a driver for Discordia, shares how he now has designated company money for expenses like parking, tolls, and fines, eliminating the need to use personal funds.

For me, Payhawk is a big win because now I always have designated company money when I'm on the road. I don't use personal funds to pay parking, tolls, or fines. And I don't have to do extra reporting — with Payhawk's mobile app, I take pictures of receipts, and they go straight to the office.

The mobile app simplifies expense reporting by allowing drivers to upload receipt photos directly to the office. CFO Tsvetomir Uzunov adds that Payhawk enables them to send money to drivers in emergencies, such as illness, ensuring they have resources for immediate needs like accommodation and medical care.

Tsvetomir says:

Now, if someone falls ill on the road, we can send them money and put them up in a hotel immediately. And with the money, they can go to the doctor, which also helps. Imagine being somewhere in the world and experiencing such an incident, but without any resources, it would be such a bad situation.

10. Kolsquare leverages AI for strategic financial management

At Influencer Marketing Platform Kolsquare, the role of the CFO is evolving as artificial intelligence (AI) and automation are integrated into financial tasks.

Alexis Klahr, CFO at Kolsquare, notes that AI allows finance teams to focus on higher-value activities by freeing them from routine tasks.

The role of the CFO is changing considerably, particularly with the advent of artificial intelligence (AI) and the increasing automation of financial tasks. Integrating Payhawk AI into financial processes enables finance teams to free themselves from routine tasks and focus more on higher value-added activities.

This tech-supported shift enhances operational efficiency and lets CFOs play a more strategic role within the company. By incorporating AI into their financial processes, Kolsquare ensures that their financial operations are not only efficient but also aligned with the company's broader strategic goals.

At Kolsquare, the business culture is "based on communication, collaboration, trust, and kindness," and within this, ESG and carbon tracking have become an increasing priority for the team.

Alexis describes:

Completing the CSRD directive isn't yet mandatory for us (given our size), but Kolsquare is a company with a mission. We've already set up an internal and external committee to monitor KPIs on CSR issues. So, once the directive applies to us, we'll already have all the foundations to be compliant.

Conclusion: Supporting spend cultures with Payhawk

The experiences of the ten varied businesses above illustrate the profound impact of creating a robust spend culture. By integrating your spend culture with your overall company culture, you can better ensure you hit your strategic goals and that no one is left in the dark about company expenses.

But having an idea about how your spend culture should look is different from seeing it in action, so how can finance teams go about making their dreams a reality?

Of course, there are hundreds of ways, one of which should be a focus on embedding financial policies into daily operations, and with us, this could involve:

- Spend policies brought to life by customisable card controls

- Adjustable approval workflows that let you ensure the right people approve the right spend

- Accountability driven by custom fields, spend categorisation, and coding: Ensuring the people who spend can accurately categorise it into the right pot with ease at the point of purchase

- Complete spend visibility all the way from payment to reconciliation via OCR data capture, expense management, and seamless ERP integrations with software like Xero, NetSuite, and more

- Procure to pay automation and Purchase Order features that support robust spend cultures by ensuring spend approval before any spend occurs

By leveraging Payhawk's advanced spend management tools, the ten businesses in this article have improved financial control, enhanced efficiency, and fostered cultures of accountability and transparency.

And by empowering employees, automating processes, and integrating technology into their operations, they have achieved greater financial control and supported sustainable growth.

Ready to revolutionise your spending culture? Book a personalised demo today to learn more about the features and practices above, gain insights on successful spending control strategies, and see our solution in action.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Best Spendesk alternatives for advanced spend management

.jpg)