Optimise financial planning prep with amortisation schedule features

Amortisation scheduling is an essential tool in financial planning. Without it, you can’t adequately manage your spend or cash flow, budget accurately, or make strategic decisions. Amortisation scheduling provides financial transparency where you need it most — from expensing intangible assets to tax planning and everything in between. Enter Payhawk: Introducing our new amortisation schedule and how to use it.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Why amortise deferred expenses?

Some expenses benefit your company over a longer period rather than just when you incurred the expense, otherwise known as ‘deferred expenses’. Deferred expenses can extend to startup costs, loan fees, insurance, or intangible assets like software, patents, or subscriptions.

Investopedia describes its top uses as:

Amortisation helps businesses and investors understand and forecast their costs over time. In the context of loan repayment, amortisation schedules provide clarity into what portion of a loan payment consists of interest versus principal.

It helps reduce taxable income and liabilities and helps you better predict when an asset might need replacing or upgrading, ultimately improving cash flow management.

Pre-approve spending and streamline procure-to-pay

The different types of amortisation schedules

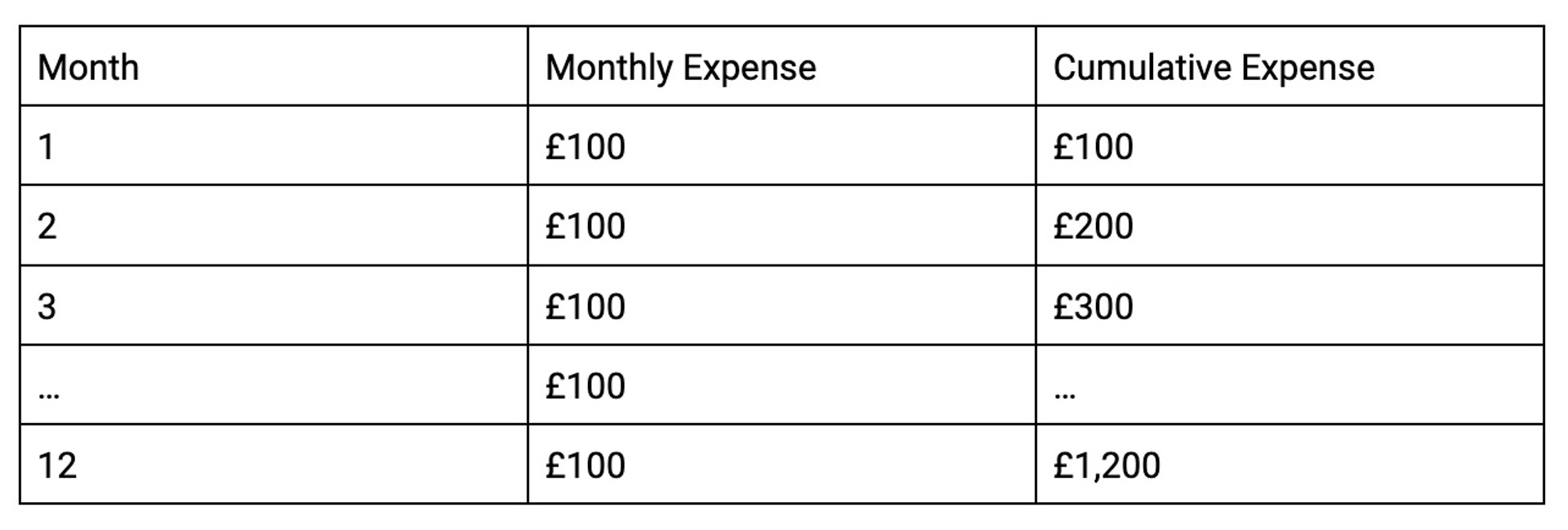

A business can use different types of amortisation schedules, but the most common and straightforward type is the straight-line method. This method is where you evenly distribute the cost of an expense over a period of time.

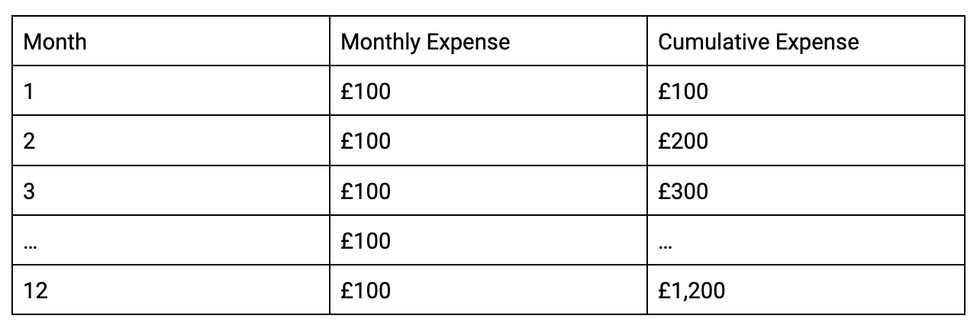

For example, you purchase a 12-month subscription that costs £1,200. Instead of recording the cost in full, you can choose to amortise it over the next 12 months. This approach means breaking down the total cost of the subscription into 12 payments of £100, which would look like the example below:

Other methods of amortisation include variable amortisation schedules. These schedules match the amortisation with the progress of a project as a percentage of the work completed.

This way, instead of recognising expenses upfront, you allocate a percentage of the expenses to align with the project work completed. For example, if you complete 25% of the project, then you expense 25% of expenses incurred, and so on, until you complete the project and the entire deferred expense costs are accounted for.

What’s the difference between amortisation and depreciation?

Amortisation vs depreciation — these two terms are sometimes used interchangeably, but there are some significant differences between them. Although they both include spreading the cost of an expense over the time the asset is in use — amortisation is the method of writing off the cost of intangible assets, and deprecation is where you write off tangible assets.

So, with amortisation, you can write off anything intangible for its projected useful lifetime — software, copyrights, patents, trademarks, trade secrets, etc. With depreciation, you can write off the cost of your tangible assets, including vehicles, equipment, property, inventory, etc.

Five benefits of amortisation schedules

Although setting up a schedule sounds time-intensive, it’s a job worth doing in exchange for financial transparency. With that in mind, what are the true benefits of creating an amortisation schedule?

- Expense costs are spread out over the period the expense is still useful, i.e. 12 months

- Helps optimise tax deductions by spreading the expense cost so you can reduce your taxable income for the year.

- Assets are properly expensed and recorded on financial statements

- Supports better budgeting and cash flow projections

- Conforms with accounting standards for accurate financial reporting

How Payhawk works with amortisations

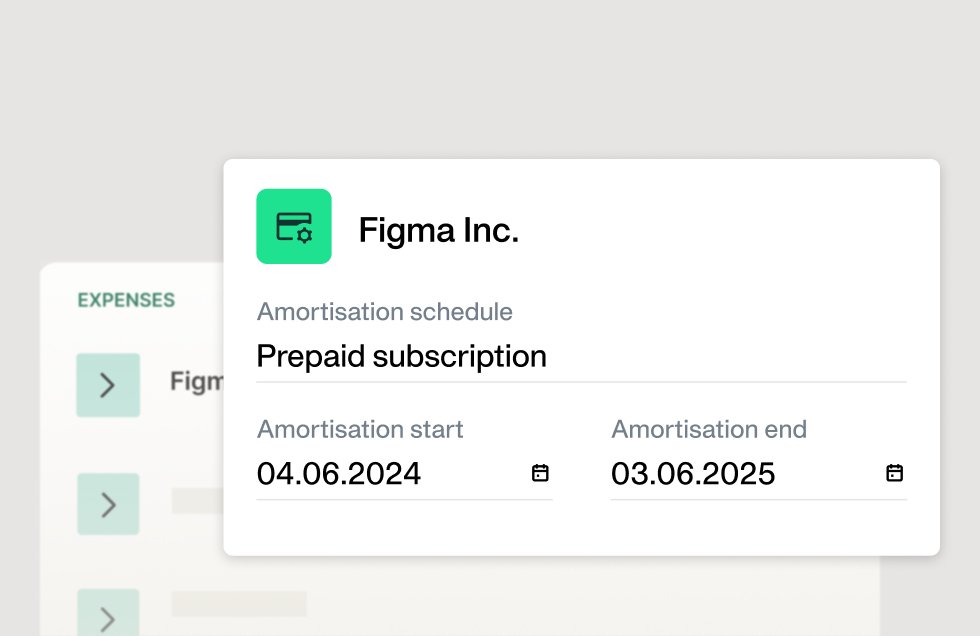

All Payhawk customers have access to the amortisation scheduler, so each of our customers can now start making accurate business decisions based on exact financial data by deferring costs. Here are four ways it works in action:

- The schedule is a composed field with three components: amortisation schedule, start date, and end date

- You can use the same amortisation template setup in your ERP, e.g. NetSuite. In Payhawk, our ERP integrations are extended to cover amortisations — both pulling in the amortisation schedules/methods you have defined in your ERP — and then sending your amortisation selection back to your ERP for the reconciliation magic to happen

- However, you don’t need an ERP connection. At Payhawk, our standard export has three columns: amortisation schedule, start date, and end date

- It’s not visible to employees and can be visible to accountants and administrators only

The logic, setup and calculations for amortisation happen within your ERP software. So, customers can simply choose the method or schedule from a drop-down, e within the Payhawk solution, enter a start and end date, and then hand the information over to the ERP to process.

Ultimately, our amortisation capabilities will save your financial planners a lot of manual work. With our new amortisation schedule, you no longer need to export the expense and manually enter the amortisation template and dates.

Any questions about how to use the new feature? Or interested in learning more about how we can help you improve financial transparency through expense management software? Request a personalised demo with one of our experts today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform