The $4.7tn problem: Hidden Costs of employee financial fraud

.jpg)

.jpg)

Did you know 75% of workers admit to stealing from their employer at least once? Uncover ways staff commit financial fraud and the shocking consequences. We’ll also share how to tackle financial crime in the digital age. Here’s a clue. It entails AI, data analytics, expense management software, corporate cards, and anti-fraud strategies.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Do you know what feels worse than losing out to financial fraud? Finding out the person who committed it is one of your own. An employee going rogue is a painful and costly blow. But sadly, this scenario is all too common. Insiders, or the conspiracy of insiders and outsiders, account for 57% of fraud cases, with companies losing $4.7 trillion to employee fraud a year.

The consequences of financial crime stretch far beyond monetary losses. So, it pays to know what you’re up against and how to prevent it. This article will expose how staff syphon resources and the eventual fallout. We’ll also share how you can use anti-fraud strategies, AI, data analytics, corporate cards, and expense management software with real-time HRIS systems integrations to make fraud attempts fruitless.

Unlock better financial controls: Explore expense management with Payhawk

The scope of financial fraud in companies

Employee fraud is rising, and occupational fraudsters are becoming craftier with their plots and schemes. Here are some of the most common types.

Nine types of financial fraud:

1. Time theft

In this scenario, staff trick their employer to get more cash from payroll than they’re entitled to. Some common ways include exaggerating worked hours and having a colleague clock in for them.

2. Expense fraud

Inflating expense reports, claiming personal expenses as business-related, and conspiring with vendors. These are just a few ways business expense fraud creeps in without adequate expense controls.

3. Financial statement fraud

Did an employee exaggerate takings and downplay expenses to paint a prosperous picture? This issue is a clear case of financial statement fraud. Workers can alter or misrepresent financial statements to deceive stakeholders.

4. Corruption

From accepting under-the-table deals to bribes for vendor contracts, employees can behave unethically. Worse, once exposed, these kinds of scenarios can severely damage your company's reputation, sometimes irreparably.

5. Asset misappropriation

This plot involves an employee misusing or stealing your company’s assets. It could look like a purchasing manager falsifying orders and pocketing the funds. Asset misappropriation forms 86% of all occupational fraud cases.

6. Forgery

Have you ever heard of an employee faking documents, signatures, or authorisations? These are forgeries, classic vehicles for theft. Forgery is more likely with paper, manual, lax expense controls, and decentralised processes.

7. Data theft

An employee can steal company information like intellectual property or customer payment details. Departing employees commit most of these cases. 70% of intellectual property theft happens within the 90 days before their resignation.

8. Identity theft

Imagine a manager stealing their colleague’s identity to make purchases or pretending to be a client to open unauthorised accounts. These are typical instances of financial crime by employees.

9. Embezzlement

Staff can abuse their position to access and divert company funds for personal use. Embezzlement often takes a collaborative effort. 79% of cases involve two or more people.

Frequency and trends of financial fraud in the corporate sector

You’ve probably heard war stories from companies attacked from within. But how much do companies lose to financial fraud? Who’s involved, and what’s the damage? Here’s an overview of the stats and facts.

Employee financial crime is rife

Get this. Companies globally lose approximately 5% of their revenue annually to employee fraud. In the UK alone, the bill is £76 million. The frequency of staff defrauding their employers is also high. From 2018-2020, companies experienced six cases of fraud on average.

No company size is safe

Despite the hefty losses, mega corps aren’t the only ones losing cash to employee fraud. 22% of small businesses have had workers sneak money from under their noses. Worse, 33% of US company bankruptcies result from employee fraud.

You could be inviting in perpetrators

When it comes to financial fraud, the people you trust often betray you. Almost half of reported cases involve collaborators like internal staff, contractors, and suppliers.

There are high-risk roles and departments for employee financial fraud

Some employee profiles and teams have a history of committing fraud. For example:

- 64% of people committing occupational fraud have a university degree or higher

- Males have defrauded their employers the most at 72%, compared to females at 28%

- Middle management (34%), operations staff (31%), and senior managers (26%) commit the most financial crimes

- Owners and executives only committed 20% of employee fraud but caused the most financial damage

- Managers commit 85% of embezzlement cases

The state of the economy affects financial crime

Some employees turn to illegal measures when facing financial issues. The cost of living crisis and looming recession are no different. Employee theft has increased by almost a fifth in England and Wales. Nearly 6,000 employees got caught stealing from their bosses in 2022, compared to 5,000 in 2021.

Understanding the Financial Impact of Employee Fraud

Employee financial fraud creates two types of losses.

Direct financial losses

- Stolen money: Employee fraud through fictitious payments leaves your business out of pocket. Worse still, the losses can be permanent.

- Lost assets: Unauthorised access to your business’s financial data or accounts can result in losing things like securities, buildings, land, and equipment.

Indirect costs and repercussions

- Legal issues: An occupational fraud case can make your business breach laws and regulations. Legal fees, fines, and penalties can soon follow, increasing business expenses and slashing profits.

- Operational disruption: Investigations, suspensions, and terminations can bring operations to a screeching halt. Work backs up, and opportunities fly by.

- Reputational damage: Stakeholders like customers can lose trust in your organisation. Next comes churn and lost sales. You’ll then have to rebuild the brand, increasing marketing costs.

- Higher insurance premiums: Following a run-in with an occupational fraudster, your company may see a spike in insurance costs due to the higher perceived risk.

- Decreased employee morale and productivity: Financial crime can create a hostile work environment that punishes innocent staff, causing them to become disengaged.

- Opportunity cost: Resources spent on uncovering fraud and launching recovery measures detract from mission-critical activities, causing lost opportunities and wasted time.

Case Studies: Real-life examples of companies losing big

There’s no teacher quite like experience. So, let’s break down some shocking real-life occupational fraud cases.

The Emma Hunt case

In 2023, a UK judge jailed an Edinburgh-based office manager for three years for living it up on her employer’s dime. Emma Hunt embezzled cash from her property firm employer to the tune of £900,000 over 32 months. How? By taking unnecessary customer deposits and diverting rent payments to her account. Hunt also created fake invoices for supplies and business expenses. Then, she had the payouts sent to her accounts. Some of Hunt’s splurges included (a):

- 5-star Caribbean holiday

- Trip to Fenton Tower for 80 people costing £39,000

- Day trips to the Scottish Open and Scotland vs England rugby match

An extreme Italian case of forgery, aggravated extortion, and abuse of office

An Italian man caused a media stir when accused of dodging work on full pay for 15 years, costing his employer £464,000. He had worked for Pugliese Ciaccio Hospital in Italy, where public sector absenteeism is widespread. Investigators reported that the suspect made threats to avoid repercussions for absenteeism. Then, he never came back to work. Six managers are also under investigation for their role in this ongoing case.

Lessons learned from past incidents

Although extreme, the above cases are very real. So, what can finance teams do to prevent these stories from playing out in their organisations?

- Have adequate internal controls to spot and block different fraud types

- Track expenses carried out by employees using comprehensive expense management software

- Use corporate cards with advanced card controls, including spending limits, limits by location, time, merchant, and automated expense reporting

- Create a robust spending policy and ensure everyone knows the rules and limits

- Don’t let executives sign off their expenses. And leverage an approval system free from conflict of interest

- Be transparent with customers about fees and processes

- Monitor employees’ activities and work status with digital solutions. And create measures to protect whistleblowers

Internal controls and risk mitigation strategies

How to implement strong internal controls to prevent fraud.

Strengthen your data management processes.

Most employee fraudsters are sneaky; 88% cover their tracks. So, know how perpetrators conceal the most common fraud types. Then, execute preventative actions. For example, when it comes to physical documents, rogue staff make (39%), destroy or hide (23%), or alter them (32%). As for electronic records, 28% create and 25% alter them. Knowing this, you could:

- Use paperless processes

- Streamline and centralise tech tools and data through integrations

- Use solutions that offer individual user accounts, access controls, author, and activity tracking

- Restrict access to financial systems to only employees who need it for their responsibilities

- Leverage software to shield sensitive data like encryption, 2FA, intrusion detection systems, and firewalls

Segregate and rotate duties

As Lord Acton put it, “Absolute power corrupts absolutely”. So, split tasks among employees and switch around job responsibilities periodically. Embrace the segregation of duties and enforce the four eyes principle with separate payment steps. You can now define different people to confirm and execute payments to prevent errors and avoid misuse.

**Build a multi-pronged risk prevention and detection strategy **

A financial fraud attack can come from any angle, so cover all bases from hiring to firing. Here are some strategic moves to make:

- Vet everyone, including staff, vendors, and contractors. Conduct thorough due diligence. For instance, verify client or employment history, references, and criminal background checks. Also, review vendor contacts, conduct site visits, and check invoices.

- Pay attention to data movement and conduct regular audits. Track access logs and use internal audits to detect unauthorised or unusual activity. For example, you could create an audit trail using expense management software. Then, conduct quarterly financial audits to examine financial statements, accounts, and transactions.

- Provide extensive employee training on fraud. Create a code of ethics and anti-fraud policies to guide staff conduct. Ensure employees know the consequences of violations. Also, promote fraud awareness, detection, and prevention through training and internal marketing campaigns. E.g., on phishing emails and social engineering.

**Make ethical behaviour the standard **

Ensure executives set an example of ethical behaviour to foster a culture of integrity. This bar could look like your business solely collaborating with ethical vendors.

Also, you could encourage open communication between departments and facilitate anonymous whistleblowing. 42% of uncovered employee fraud cases come from tips, with more than half of these from staff. So, this action alone will significantly improve your fraud detection.

Rebuilding trust and reputation after fraud incidents

So, your company has suffered a financial crime case, and its reputation has nosedived. What now? Here are some of the most shared tips online to help you reset.

Restore stakeholder confidence

- Use surveys and feedback sessions to understand stakeholders’ feelings, questions, and concerns

- Take decisive action quickly

- Leverage external audits and reviews. Communicate their initiation and publish findings

- Voice the actions your company is taking to ensure security and rebuild trust

Communication strategies for transparency and accountability

- Share timelines for changes publicly

- Have an open-door policy

- Use channels like town halls and webinars to answer stakeholders’ questions

- Keep collecting feedback and implement suitable suggestions

Legal and compliance considerations

Legal ramifications for companies and employees involved in fraud:

Financial fraud cases don’t just hurt your company’s pocket and standing; they can also put it in legal hot water. We’re talking about criminal charges, civil and class action lawsuits, fines, asset forfeiture, regulatory sanctions, etc. For instance, under the Economic Crime and Corporate Transparency Act 2023, the UK government holds companies liable for an unlimited fine if their employees or agents commit fraud unless it can prove it tried to deter them.

Technological solutions for fraud detection

The role of Artificial Intelligence and Data Analytics in fraud detection:

Gone are the days of trusting gut instinct or hoping to catch employees in the act. Using technology, your finance team can auto-scan for financial fraud in real time, 24/7. Think using algorithms for pattern detection, anomaly recognition and flagging, identity verification, predictive modelling, and behavioural analysis across large datasets.

You can also automate decision-making to prevent overwhelm and mistakes in your finance operations, which are common ways employee fraud can slip through the net. For example, with Payhawk, you can leverage spend automation and AI, like Plan A did.

Plan A used Payhawk to execute internal controls, real-time reconciliation, and scale access to employee expense cards faster and more efficiently. Plan A also uplevelled company spending transparency among department heads with approval workflows. Plus, they save two days’ worth of manual accounting admin — giving them more time and opportunities for analysis and optimisation — while keeping their funds and assets safe.

Tools and software for proactive fraud monitoring

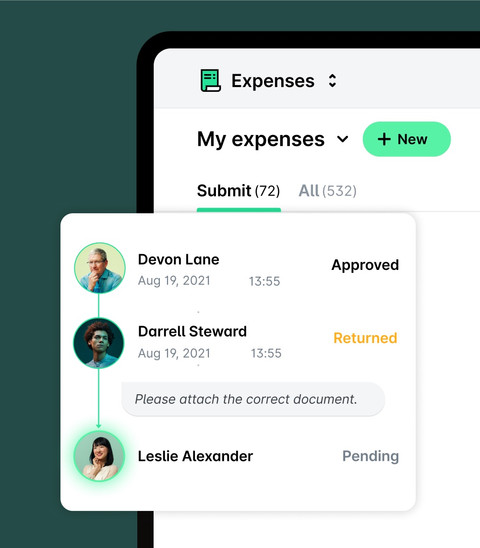

- Expense management software: Whether you’re reimbursing staff or preparing the books for month-end, this solution will help you track and optimise budgets and expenses. You can also use real-time reconciliations, making business spend control quick and easy.

- Corporate cards: Are you tired of shocks when staff reimbursement requests roll in? Upgrade your business expense control efforts with employee expense cards a.k.a, business expense cards. Use features like spending limits, access controls, and data tracking to curb financial fraud.

- OCR technology: Thanks to cutting-edge solutions, you can leave fiddling with physical receipts and manually keying in data in the past. For instance, Explose uses Payhawk’s OCR technology and AI camera to extract key receipt details, auto-populate multiple fields, and identify duplicate invoices for rapid, pain-free processing.

- AI fraud detection tools: An exciting capability of AI-backed finance systems is they keep learning and adjusting their strategies to catch changing fraud patterns. This artificial learning means the AI-powered solutions’ accuracy improves more and more over time to stay effective against emerging threats.

- Data integrations and analytics: Want to drive transparency and get a more accurate view of company operations and finances? Pool data from key business areas and use data analytics tools to spot trends and guide fraud prevention strategies. Finance teams often use ERP integration, HRIS integration, and accounting software integration to push insights to expense management software, so make sure you have control over all the data where you need it without switching tools and screens.

Don’t get duped

Financial crime isn’t going away. Occupational fraud can lie undetected for years without the right tools, approach, and culture. Worse, employee fraud isn’t a victimless crime. It can cause bankruptcies, job losses, tarnished reputations, and more.

It’s essential to be steps ahead of rogue employees’ plots and schemes. Invest in solutions that level up business spend control, like comprehensive expense management software. Also, keep training staff and improve your financial fraud prevention strategy in light of new developments. Soon, your company will be more secure than Fort Knox.

Want to find out more about how Payhawk can help protect your company against employee expense fraud? Check out our detailed corporate cards page for more information on card controls, checks, and security features.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Best Spendesk alternatives for advanced spend management

.jpg)