How to master card, bank, and invoice reconciliation and how it will benefit your business

Payhawk simplifies reconciliation with automated processes and accounting software integrations. Find out how to reduce errors, get real-time visibility, manage data efficiently, and save hours on manual reconciliation.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

If you're part of the finance team at a larger or growing business with complex financial operations and multiple revenue and expense sources, you probably find reconciliations particularly challenging.

Getting accurate reconciliations is stressful, from discrepancies between records to missing information. And finally, the pressure to reconcile quickly and accurately is enormous, especially when it comes to managing cash flow and meeting reporting deadlines.

What is card reconciliation?

Companies follow the card reconciliation process to match all transactions listed on a company's bank statement with its corresponding accounting records.

Performing card reconciliation ensures that the business, finance team, and cardholders have recorded all of their spend accurately and helps identify any discrepancies or errors. The process typically involves comparing the transactions listed on the bank statement with those recorded in the accounting records and then resolving any differences or making necessary adjustments to ensure accuracy.

The ultimate guide to ERP x expense management integrations

What are the main steps in card reconciliation?

To perform card reconciliation, your finance team must match the bank statement transactions with the company's accounting records.

The main steps in card reconciliation include doing the following:

- Gather all relevant information: Obtain a copy of the bank statement, any receipts or documentation related to the transactions, and the company's own records of the transactions

- Compare the transactions: Go through each transaction on the bank statement and match it to the corresponding transaction in the company's records. If a transaction hasn't been recorded in the company's records, add it to the reconciliation process

- Identify and resolve discrepancies: If discrepancies exist between the bank statement and the company's records, investigate and resolve the issues. These issues could be due to errors in record-keeping, bank errors, or fraud

- Update the company's records: Update the company's records to reflect any changes made during the reconciliation process

- Review and approve the reconciliation: Review the entire reconciliation process to ensure that all transactions have been correctly matched and all discrepancies have been resolved. Once satisfied, approve the reconciliation and make any necessary adjustments to the company's accounting records

- Document and retain records: Document the reconciliation process, including any changes made and the reasons for those changes. Retain a copy of the reconciled bank statement and any related documentation for future reference

How do businesses get card reconciliation wrong?

There can be several reasons why businesses get card reconciliation wrong:

- Manual errors: Human error is a common cause of incorrect card reconciliation. For example, manual entries may be transposed, duplicated, or recorded in the wrong account

- Lack of documentation: If businesses don't have clear documentation for their card reconciliation processes, it can lead to inconsistencies and mistakes

- Incomplete or missing transactions: If transactions are not recorded in a timely manner or if some transactions are missing, it can result in an incorrect reconciliation

- Inconsistent categorisation: If transactions are not consistently categorised or if there are inconsistencies in how different transactions are recorded, it can lead to incorrect reconciliation

- Inadequate technology: Using outdated or inadequate technology can lead to incorrect card reconciliation. For example, if the system can't handle multiple currency transactions or if it can't reconcile transactions in real time, it can result in incorrect reconciliation

- Lack of training: If employees don't know how to reconcile cards, it can lead to mistakes

Businesses need to have clear and documented reconciliation processes, use technology designed for the task (which also supports automation), and train employees to reconcile cards correctly to avoid the above mistakes.

Real-time reconciliation explained

What is bank reconciliation?

The bank reconciliation process matches the account balance within a business or entity to a company's latest bank statement. If there are any discrepancies between the two figures, then the finance or accounting team needs to check back through the statement and fix them accordingly.

For many businesses, the reconciliation process is now mostly automated, but there's still a lot of manual work involved for some companies.

Payhawk customer MDM Props shared the challenges of performing accurate bank reconciliations before switching to Payhawk as their spend management solution.

"We have large volumes of transactions, and before Payhawk, our payment reconciliation process was manual. It took months to catch up as we had to enter the net amount, the VAT, and what project it was related to," MDM Props' Finance Manager Uchenna explained. "Now, with Payhawk, it's so much easier as the OCR captures all relevant receipt data, and we can code it correctly from the outset using the custom fields."

What are the different types of bank reconciliation?

There are three, or technically five types of bank reconciliation.

Bank reconciliation (and inter-company)

Here companies must reconcile bank statements with any of their recorded transactions. They must ultimately reconcile the balances in their subsidiary’s books towards the parent company’s books.

Customer reconciliation

Businesses are the vendor here and must ensure that their books balance with their customers’ books and there are no discrepancies.

Vendor reconciliation (business-specific reconciliation)

Businesses are the customer here and must ensure that their books balance with their vendors’ books and there are no discrepancies. Companies must check to see if the services or goods they receive from the vendor are the same as they have recorded.

What are the main steps in a bank reconciliation?

No matter the size of the business, there are several important steps to complete the entire bank reconciliation process; these include:

- Checking their bank records

- Pulling together their business records

- Checking bank deposits

- Checking withdrawals

- Investigating the company income

- Combing through and checking the expenses

- Adjusting the bank statements and cash balance

- Analysing and checking the end balances

What is the purpose of preparing for a bank reconciliation?

Bank reconciliation is vital and helps to swerve any inconsistencies that are important for audit and tax purposes.

Performing the bank reconciliation process also ensures you have an accurate view of how much money is coming in and going out of your bank account so you can make important decisions that will affect the health of your business. From savings to investment, companies need to see their spend correctly, so they manage budgets and reroute funds as necessary.

What is invoice reconciliation?

Invoice reconciliation is an essential step in the accounts payable process to ensure accuracy and prevent discrepancies when it comes to payment.

By comparing the invoice and purchase order and receiving a report, you can confirm the accuracy of any of your charges and ensure that you received all the correct goods or services that were specified in the agreement.

The traditional invoice reconciliation process looks something like this:

a) Get the invoice information from the ERP or database

b) Open the online banking website

c) Introduce the credentials or token

d) Manually enter the bank account number, bank name, supplier name, and amount into the online banking portal

d) Reconcile the transaction in the company's books via accounting software

What does invoice reconciliation mean for finance professionals?

For finance professionals, invoice reconciliation is more than just a step in the accounts payable process; it's a fundamental tool for financial integrity and control. This process, which involves comparing invoices to purchase orders and receipts is critical for four main reasons:

- Accuracy and compliance: Ensuring that the amounts billed match the agreed-upon prices and quantities is vital for maintaining accurate financial records. This accuracy is crucial for compliance with financial reporting and auditing standards.

- Fraud detection: Invoice reconciliation helps in identifying fraudulent activities, such as irregular payment amounts or invoices from unfamiliar vendors. This is especially important in an era where digital fraud is on the rise.

- Operational efficiency: By streamlining invoice reconciliation, finance professionals can enhance operational efficiency, reducing the time and resources spent on manual checks and corrections.

- Financial health: Accurate reconciliation directly impacts a company's financial health. It ensures that businesses only pay for what they receive, preventing losses due to overpayments or fraudulent charges.

Invoice reconciliation is indispensable for finance professionals to maintain financial control, uphold compliance, detect fraud, and ensure operational efficiency.

Invoice reconciliation: timing challenges

In the 'olden days' (pre-spend management software x accounting software), one of invoice reconciliation's challenges was timing. And when exactly payments would show up on your balance sheet.

For example, if you deposited on Friday, but it didn't show in your account until Monday, then you'd have errors if you performed your invoice reconciliation in between.

You could also be left in limbo, waiting for your vendors to cash any cheques you sent.

Invoice reconciliation: How to recognise fraudulent activity

When reconciling invoices, you must be sure to check for fraudulent behaviour by looking for red flags or unusual patterns. Take for example the recent phishing scam case, involving Quanta, Facebook, and Google, where over $100 million was paid out for fake invoices. Some common red flags include the following:

- Invoices with irregular payment amounts: If an invoice has a payment amount that is very different from previous payments

- Invoices from unfamiliar vendors: If you receive an invoice from a vendor that you don’t recognise

- Invoices with missing or incomplete information: If an invoice is missing important information, such as a company name or contact details

- Invoices with incorrect payment details: If an invoice has incorrect payment details, such as a misspelled name or incorrect bank account number

- Invoices with inconsistencies in the amount or description: If an invoice has inconsistent or conflicting information about the amount or description of the goods or services being charged

If you suspect fraudulent behaviour when reconciling invoices, you need to take steps to protect your business. This may include contacting the vendor to verify the invoice, reviewing the payment records, and taking legal action if necessary.

Why does invoice reconciliation matter?

Invoice reconciliation is the process of comparing supplier invoices against purchase orders and receipts. The purpose of invoice reconciliation is to ensure that the amounts billed on the invoices are accurate and match the quantities and prices agreed upon in the purchase orders. The process also helps to identify and resolve any discrepancies or errors, such as overcharges or missing items, promptly.

Invoice reconciliation is an essential part of financial management and helps organisations maintain accurate financial records and prevent loss due to fraud or errors. It also helps a business manage its bill payments accurately to ensure it only pays for the goods and services it receives.

In summary, the purpose of invoice reconciliation is to:

- Verify the accuracy of invoices

- Pay suppliers correctly

- Prevent overpayments or underpayments

- Maintain accurate financial records

- Identify and resolve any discrepancies or errors

How to improve the reconciliation process at your business

Reconciling your card payments and vendor invoices is time-consuming but vital. If your business is still doing much of this work manually or with multiple solutions, then there is a better way.

Your business needs to start leveraging software that will make the reconciliation process more automated and efficient and reduce manual errors.

Companies of all sizes have a few big asks when it comes to the reconciliation process and managing their business spend. They need to:

a) capture data spend data easily, including from card payments and invoices

b) ensure the data is synced perfectly with their chosen accounting software or ERP

c) get real-time reconciliations flowing in order to get an accurate picture of the businesses’ cash flow

At Payhawk, we do all of these things and more.

Payhawk’s spend management solution includes smart OCR technology across both the desktop platform and mobile app that can pull out and grab the most important receipt and invoice data in seconds.

Achieving easy card and invoice reconciliation

With Payhawk, your business has a complete spend management solution, including company cards, expense management, invoice management, and more.

Cardholders have corporate cards connected to expense management software via an easy-to-use app and admin portal. All they need to do is spend (within limits already set by the finance team in the solution), upload their receipt via a quick snap, and select the spend categories (from a list created by the finance team).

"The Payhawk app is so smart and intuitive," said Alessandro Lupo, Finance Director at Club Freelance. "The team loves the app because it's easy and straightforward for everyone to use. We've also seen fewer mistakes now that the built-in OCR tech captures all the receipt data once someone uploads a receipt. So, all they need to do is choose the right expense category, etc."

The OCR technology pulls out all the relevant data to ensure that there are no missed fields, and no gaps in info. And, if your colleague forgets to upload their receipt? The solution chases them automatically until they do.

Payhawk customer, ATU, managed to save over €2m in VAT reclaims by using company cards and correctly categorising receipts at reconciliation.

"We no longer have to chase receipts. Since using Payhawk, managers must simply take a picture of their receipt — thus digitising it — and enter it into the automated finance system. In the first year, this change resulted in ATU recouping € 2 million from the tax office that would have otherwise been lost," Mathias Goet, Senior Project Manager at ATU, explained.

Clever invoice reconciliation

Like, the card payment receipt reconciliations, invoice reconciliations are easy with the OCR and custom fields in Payhawk.

We surveyed our customers about what paying and reconciling a single invoice looked like before Payhawk. They explained that it could take up to 15 minutes to pay and involved multiple people.

With Payhawk, it takes just seconds. As the OCR pulls all of the relevant data out, the person submitting the invoice selects a couple of custom fields, adds a comment, and the job's done.

The process means that the categorisation is decentralised, and the finance team can make strategic decisions for the business instead of drowning in invoices and chasing up missing info.

Invoice and card reconciliations: integrating with your ERP and accounting software

At Payhawk, our integration strategy supports finance professionals and accountants to work fast and swerve errors. We created our ERP and accounting software integrations in accordance with the accruals concept by differentiating between the invoice/receipt and payment recognition dates, meaning your finance team can:

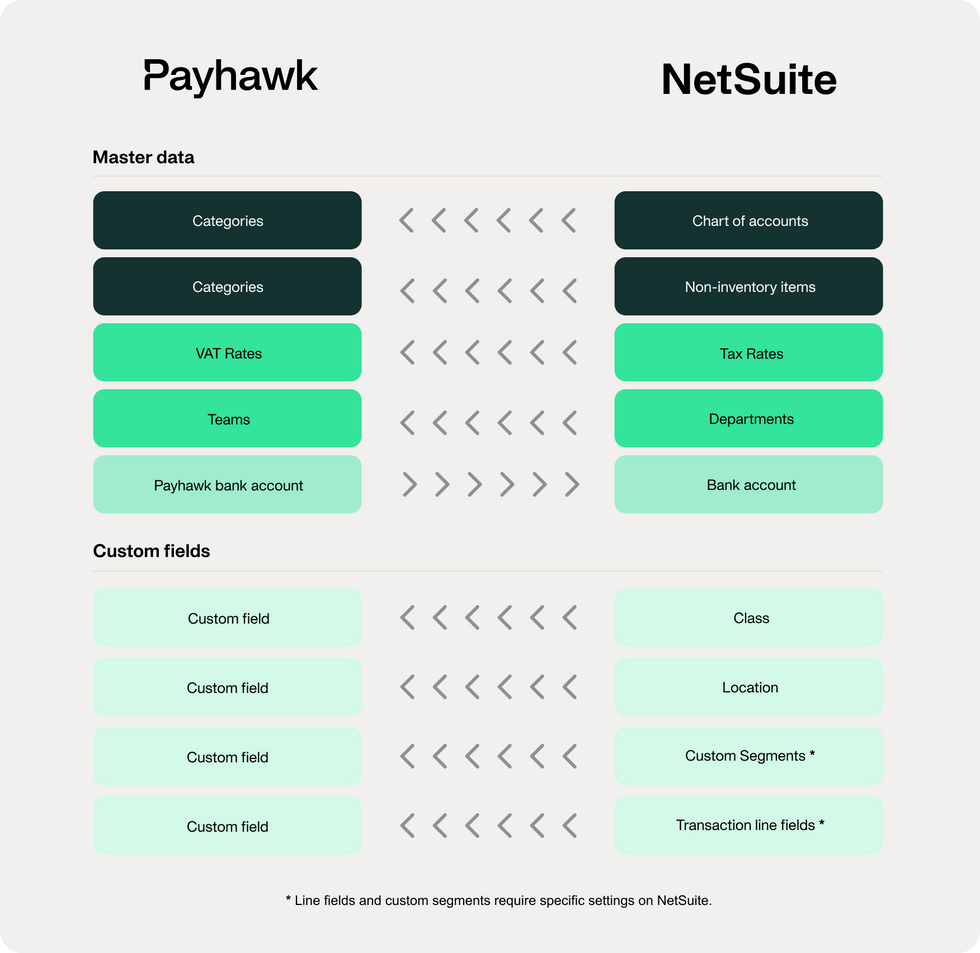

- Transfer company expense data seamlessly and with zero effort. We integrate with NetSuite, Xero, Exact Online, Datev, Microsoft Dynamics, and QuickBooks

- Accurately see, track, and record real-time transactions in real time

With Payhawk, you save time and effort by digitising your spend data via the OCR, categorising it correctly with automation, and transferring it effortlessly into your ERP or accounting software. All that, and the company's card spend is within limit thanks to the spend control rules you set up before giving out your corporate cards.

What about missing receipts?

The true cost of missing receipts can be enormous, as ATU and MDM Props shared above.

But with the easy-to-use app and platform, receipts and invoices are easy to manage and capture. And if there are missing receipts? The solution automatically chases them to ensure no spend data goes unrecorded.

Collecting receipts can mean big VAT reclaims for businesses, and our integration with 60dias means you can even file backdated receipts.

"The recovery of VAT can be retroactive for a period of up to four years in some cases," Sergio Pérez Vegas, technical managing partner (and tax inspector on leave specialising in VAT) at 60dias, told us. "Meaning you can recover VAT on receipts from two years ago but feel the benefit before this year-end."

Beyond VAT reclaims: Preparing your audit trail

Beyond the benefits of VAT reclaims and efficient month-end close, proper reconciliation can make or break the accuracy of an audit trail.

Spend management solutions, like Payhawk, can take care of many of your audit trail steps without error or effort. No mistyped expense amounts thanks to the OCR, and no confusing spend categories thanks to the custom fields suggested by your in-house finance team.

Like what you see?

Invoice and card reconciliations are vital but don't have to be complicated. Book a demo to find out how your business could improve reconciliations to save time, money, and stress.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Why you should integrate Dynamics 365 Business Central with Payhawk